HREI editorial board members discuss the current difficulties associated with debt

By John B. Mugford

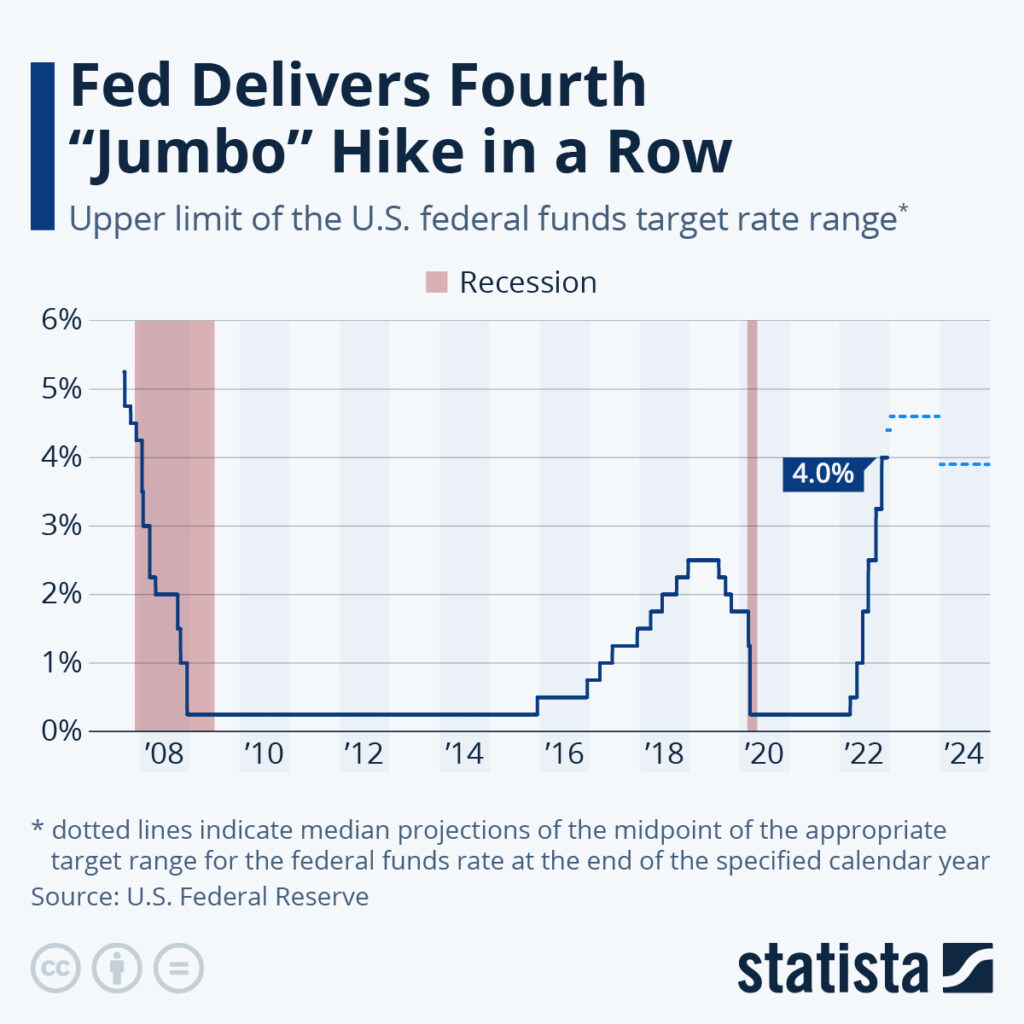

The long-term strength of the HRE sector doesn’t mean there won’t be choppy times – and this is one of them, industry sources say. (Chart courtesy of Statistica)

Spooked by economic uncertainty, most major publicly traded healthcare real estate (HRE) lenders have “put their pencils down” for the rest of 2022, making it difficult for developers and investors to obtain debt. So 2023 development and sales volume will largely depend on when economic conditions stabilize sufficiently for those lenders to feel comfortable getting “back in the game.”

That was the general consensus of about two dozen HRE authorities who gathered recently via Zoom to discuss current market conditions and the prospects for 2023. Those industry experts are members of the HREI™ Editorial Advisory Board, which is comprised of executives and professionals with many of the sector’s most active firms involved in HRE investment, brokerage, development, ownership, leasing and law.

To be sure, those same HREI board members continue to profess unwavering confidence in the long-term prospects of the HRE space. As we noted in a previous report, they say that favorable demographics and the essential nature of healthcare make it a near certainty that the HRE business will continue to grow and thrive in the years to come.

But that doesn’t mean there won’t be choppy times – and this is one of them. Business conditions will be challenging in the short term, the board members agreed, especially for those looking to acquire or develop facilities in the coming months.

In this article, we’re taking a closer look at a portion of the HREI board discussion that was heavily focused on the current state of financing, both debt and equity, in the HRE space, with an emphasis on the current challenges associated with debt.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE