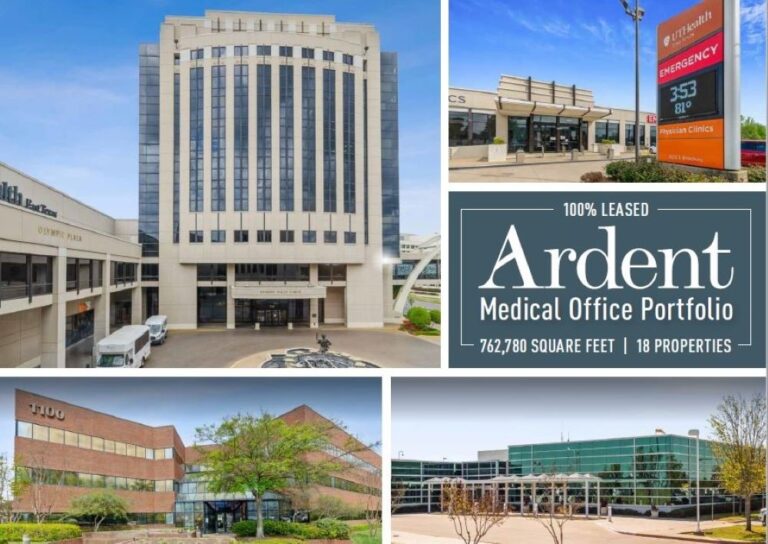

Ardent Medical Office Portfolio

762,780 Square Feet | 18 Properties | Absolute Net Master Leases

The Offering

Jones Lang LaSalle Americas, Inc. (“JLL”) is pleased to offer for sale The Ardent Health Medical Office Portfolio (the “Portfolio”), a unique opportunity to invest in over 762,000 square feet of medical office buildings leased by partnerships between Ardent Health Services, a leading national private for-profit integrated healthcare provider based in Nashville, Tennessee, and two market-leading academic health systems, The University of Texas Health Science Center at Tyler and The University of Kansas Health System. The institutionally-managed Portfolio consists of 18 fully occupied properties in Texas (16) and Kansas (2).

Upon sale, the Portfolio will be 100 percent leased under new absolute net master leases with substantial 12 years of term and contractual annual rental escalations of two percent, offering durable in-place cash flows and growth in income. The Portfolio features 13 buildings on hospital campuses representing 91 percent of the rentable area of the Portfolio. The underlying occupancy is nearly 100 percent and the health systems directly occupy 80 percent of the Portfolio net rentable area. Each of the properties represents strategic on and off-campus locations featuring mission critical infrastructure and a variety of critical medical uses. The Portfolio offers desirable scale to investors in concentrated geographic patient service areas. The properties are a combination of leasehold interests in campus locations with long-term ground leases and fee simple interests in community locations. The Portfolio will be delivered free and clear of mortgage encumbrances to the purchaser.

Investment Highlights

INSTITUTIONAL-QUALITY MEDICAL OFFICE PORTFOLIO

• 100% leased featuring 80% direct health system tenancy – fully occupied buildings

• 91% of rentable square feet concentrated on campus

• Portfolio comprised of nine single-tenant and nine multi-tenant buildings

• Institutionally managed by a highly regarded and experienced health system owner-operator, Ardent Health Services

SCALE IN MEDICAL OFFICE

• Exceptionally rare opportunity to acquire a large scale, institutional medical office portfolio with a single healthcare system comprised of 762,780 rentable square feet across 18 properties

• Geographic concentrations in Texas and Kansas

• Average building size over 40,000 square feet

ALIGNMENT WITH LEADING HEALTH SYSTEMS

• 100% master leased by affiliates of UT Health East Texas and KU Health-St. Francis

• UT Health Tyler and KU Health – St. Francis enjoy 39% and 26% inpatient market shares, respectively

• 80% direct health system occupancy across the Portfolio

• Strategic outpatient strategies for each health system or third-party provider groups

• Opportunity to partner and strengthen relationships with Ardent Health Services and its premier academic health system partners, The University of Texas Health Science Center at Tyler and KU Health

HIGHLY STABLE INCOME STREAM

• Absolute net lease structures and contractual rent escalations provide predictable and growing income stream with no capital requirements

• High probability of renewal in-place with strategic locations and critical infrastructure

• No tenant termination rights

• Modest in-place rents allow for consistent NOI growth across the Portfolio and a favorable basis for investors

Contact Information

Brian Bacharach

Managing Director

O +1 214 438 6462

brian.bacharach@am.jll.com

Vasili Davos

Vice President

O +1 214 438 6151

vasili.davos@am.jll.com

Mindy Berman

Senior Managing Director

O +1 617 316 6539

mindy.berman@am.jll.com

Financing

Daniel Turley

Senior Managing Director

O +1 214 438 6374

daniel.turley@am.jll.com

Andrew Milne

Managing Director

O +1 858 812 2370

andrew.milne@am.jll.com

Although information has been obtained from sources deemed reliable, neither Owner nor JLL makes any guarantees, warranties or representations, express or implied, as to the completeness or accuracy as to the information contained herein. Any projections, opinions, assumptions or estimates used are for example only. There may be differences between projected and actual results, and those differences may be material. The Property may be withdrawn without notice. Neither Owner nor JLL accepts any liability for any loss or damage suffered by any party resulting from reliance on this information. If the recipient of this information has signed a confidentiality agreement regarding this matter, this information is subject to the terms of that agreement. ©2019 Jones Lang LaSalle IP, Inc. All rights reserved.

Sent by JLL – Investment Sales – Healthcare, One Post Office Square , Boston, MA 02109. Unsubscribe

RCM is the global marketplace for buying and selling commercial real estate.

Learn more about our solutions at www.rcm1.com.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE