ULI session praises the ‘durable cash flows’ of ‘alternative’ product types

By Murray W. Wolf

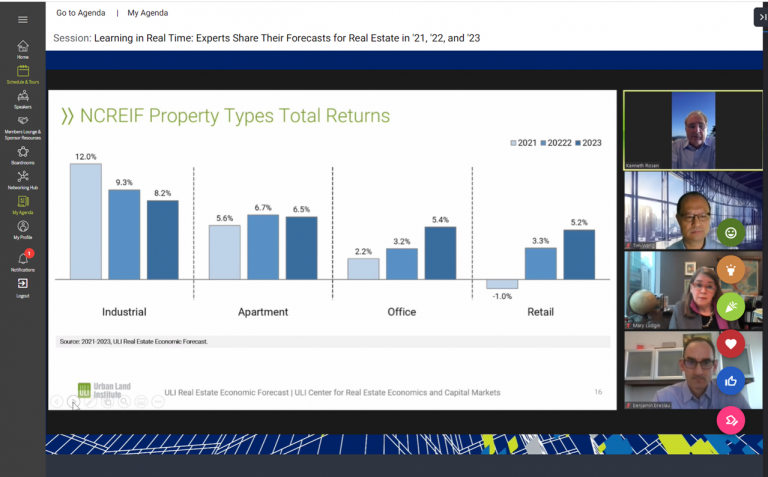

The industrial sector far outpaced the three other largest commercial real estate sectors last year in terms of total returns and is projected to continue to do so through at least 2023, according to ULI. (HREI™ photo)

As part of the virtual version of the 2021 ULI Spring Meeting, the Health Care and Life Sciences Council (HCLSC) is scheduled to hold several Zoom meetings next week.

But healthcare and life sciences were already being talked about this week as the general sessions began – and the tone was favorable.

On May 10, during the opening session of ULI’s spring event, which presented and discussed the results of the organization’s annual Real Estate Economic Forecast, panelists had only good things to say about the two “alternative” asset classes.

Noting that her firm has been investing in medical office and self-storage for several years, Mary Ludgin, senior managing director and director of Global Investment Research for the Chicago-based real estate investment management firm Heitman, said both product types have fared well during the COVID-19 pandemic.

She noted that

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE