Healthcare Capital Markets Perspective

September 2017

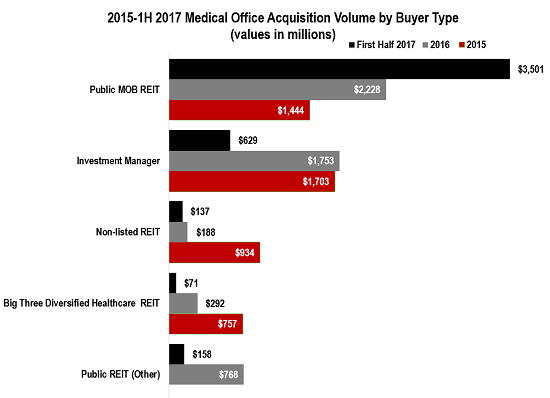

- Public MOB-specialist REITS were the top buyers in early 2017 by a long stretch – their share prices were nicely rewarded given the stable and durable income profile of medical office.

- Healthcare Trust of America and Physicians Realty Trust were the most prolific with total acquisitions of $3.4B – nearly two-thirds of 1H 2017 sales of $5.4B (MOBs larger than 25,000 SF) – driven by $2.2B of Duke Realty’s healthcare assets.

- Institutional managers remain active given high levels of fundraising focused on healthcare and medical office.

- The Big Three healthcare REITs – HCP, Welltower and Ventas – remained disciplined with acquisitions while non-listed REIT fundraising has limited their supply of new investment capital.

- Collectively, these investor groups represented 83% of all MOB sales in the first half, the highest concentration ever, signaling that investment capital is following experience.

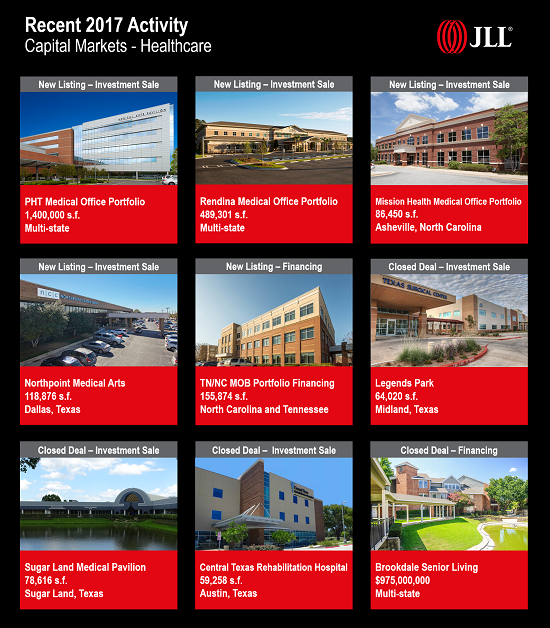

JLL Healthcare Capital Markets

JLL Healthcare Capital Markets is the only national full service healthcare capital markets team in the real estate industry focused on medical office, hospitals, seniors housing and post-acute care. The team consistently transacts over $1 billion annually with unrivaled expertise and experience in investment sales, monetization, development debt and equity capital raise and advisory services for investor and provider clients. JLL has an extensive national and international presence that delivers local market knowledge and exceptional access to capital.

Contact Us:

Mindy Berman

Managing Director

+1 617 316 6539

Daniel Turley

Executive Vice President

+1 214 438 6374

Steve Leathers

Executive Vice President

+1 212 812 5867

Brian Bacharach

Executive Vice President

+1 214 438 6462

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE