Data firm Revista releases most recent Top 50 owners report. Health systems still dominate and Kaiser is still the king.

By John B. Mugford

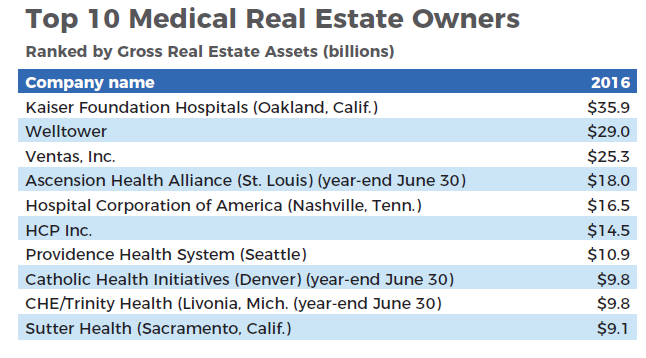

As has been the case for each of the past four years, the king of healthcare real estate (HRE) remains, according to a new report, Kaiser Foundation Hospitals, part of Kaiser Permanente, the massive health system and health insurer with nearly 12 million members in a number of states.

Based on year-end 2016 data, the new report from HRE data firm Revista found that with about 40 hospitals, nearly 700 medical office buildings (MOBs) and other holdings, Oakland, Calif.-based Kaiser Permanente owns a portfolio of properties with a value of about $35.9 billion. That tops the next largest owner, Toledo, Ohio-based Welltower Inc. (NYSE: HCN), by nearly $7 billion.

The portfolio owned by Welltower, a publicly traded real estate investment trust (REIT), was worth an estimated $29 billion at the end of 2016, which includes MOBs, senior housing facilities and a variety of other medical facilities, according to Arnold, Md.-based Revista.

The rankings and figures come by way of a newly updated report titled, “Top 50 Owners of Medical Real Estate” from Revista, which was formed in 2013 to compile and analyze a comprehensive database of all of the country’s medical

facilities.

The report includes entities whose portfolios are predominantly comprised of what Revista Principal Mike Hargrave says are true “healthcare” facilities, which include MOBs, hospitals, post-acute and rehab facilities, skilled nursing facilities (SNFs) and others.

Not included are entities that primarily own independent senior living facilities.

As a result, senior housing properties, as well as any other types of non-healthcare properties, are included in the total assets of some of the entities in the Top 50. That’s because companies such as Welltower, Chicago-based Ventas Inc. (NYSE: VTR), which predominantly own hospital-related facilities, as well as some of the others on the list, own senior housing and other property types.

In compiling its data for the Top 50 report, Revista gathers data from entities that file year-end balance sheet reports, such as for-profit and not-for-profit health systems and healthcare-focused real estate investment trusts (REITs), the largest contingent of non-health system owners of real estate. In determining the dollar value, Revista uses the most recent sale price for properties, the cost of new developments or both.

“What this is meant to be is the only report out there that, on an apples to apples basis, looks at the largest owners of healthcare real estate,” Mr. Hargrave says.

“Before we started this report, it was a long sought-after question: how the REITs compare in ownership to the hospital systems. This is the first report to sum that up.”

He acknowledges that the report’s methodology for gathering the data might not be perfect, “as we’re essentially using gross undepreciated book value. So, it’s the cost for which they acquired or developed the assets.

“But it’s really the only way that we can readily compare the top 50 owners using what data is publicly available.”

Health systems still dominate

Although Kaiser Permanente has retained the top spot, the other four organizations in the top 5 have held their spots as well since 2013. (Revista issued its first Top 50 report in 2014, based on data from 2013.)

Those owners are the previously mentioned Welltower and, at No. 3, Ventas, which had a portfolio of $25.3 billion at year-end; No. 4 St. Louis-based Ascension Health Alliance, a not-forprofit system whose portfolio was worth $18.08 billion; and, at No. 5, Nashville, Tenn.-based for-profit provider Hospital Corporation of America (HCA) Inc., with a real estate portfolio worth $16.5 billion.

Source: Company Filings, company data submissions and Revista Research. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on revistamed.com and with proper credit to Revista or Revistamed.com.

As has been the case since Revista issued its first Top 50 owners report in 2014, the HRE ownership landscape remains dominated by hospitals and healthcare systems.

However, this time around, more non-health system owners cracked the top 50, with 14 such companies included in the 2016 ownership rankings. Back in 2013, only nine non-health system owners were ranked in the top 50

REITs have made inroads

The REITs on the list have made substantial inroads into owning a bigger share of the real estate owned by those in the Top 50. As of the end of 2016, the REITs on the list held 32 percent of the property, an increase from the 27.8 percent they owned just four years ago.

“Many of us who work for the country’s healthcare-focused REITs and other large owners of healthcare real estate, have, for a number of years, thought that we would see gradual growth in the amount of real estate owned by non-health system firms, as the health systems themselves would come to realize that they might not want to own all of their real estate,” says Daniel Klein, senior VP of investments and deputy chief investment officer with Milwaukeebased Physicians Realty Trust (NYSE: DOC, which is ranked second in Revista’s current report for year-over-year HRE ownership growth.

“And I do think we are starting to see that change, even though it is gradual.”

That change is taking place, both Mr. Klein and Mindy Berman, managing director of capital markets with Chicago based Jones Lang LaSalle (NYSE: JLL), say as more and more health systems are considering adapting a more corporate style approach to occupying real estate.

That corporate approach has large entities leasing instead of owning much of the real estate they occupy.

HRE sector professionals note that some systems are looking for more of a balance between the amount of real estate they own and lease.

Selling, or monetizing, assets can provide a health system with an influx of needed cash and can provide other benefits that come with having experienced, healthcare-focused real estate firms owning and managing the properties the systems occupy.

“I have not met with many health systems that say they have enough money for all of the endeavors they would like to accomplish,” says Mr. Klein.

“And with all of the things health systems need to be involved with these days, it makes sense that they would like to have their real estate owned and managed by professional firms so that they don’t have to worry about that part of the equation as well.”

Although perhaps two or three out of every 10 health systems might be open to monetizing assets or having third-party developers build and own facilities for them, many are not, according to Mr. Klein and Ms. Berman of JLL.

“I don’t expect to see a system like Kaiser selling assets anytime soon,” Ms. Berman says.

“In fact, they have been acquiring some of the assets from third-party owners that they’ve been leasing. But this (Top 50) report, while it does not necessarily show this, does indicate that the universe of tradable healthcare assets has grown, which is important.”

Mr. Klein, using other estimates, says that the country’s health systems still own anywhere from 60 percent to 70 percent of the country’s MOBs; a figure he and others believe has dropped from about 80 percent in recent years. Most of the health systems, of course, still own their hospitals.

One of the companies leading this charge toward non-health system ownership of hospital-related properties is the firm Mr. Klein works for, Physicians Realty Trust (DOC).

At the end of 2015, DOC’s portfolio, which is comprised almost exclusively of MOBs, stood at $1.6 billion. In just a year, the REIT grew its portfolio to $2.9 billion, for year-over-year growth of 78.5 percent, giving it the top ranking of any organization in that category.

It should be noted that DOC is just four years old and that when factoring in the deals it has closed in 2017 it has most certainly crossed the $3 billion mark.

It’s an example of how the REITs continue to gain HRE market share, Mr. Hargrave notes.

“Some REITs have been growing very fast, as I think there’s an opportunity – given the low cost of capital that the REITs can access and the fact that most acquisitions these days can be immediately accretive to earnings – for them to continue to grow significantly,” he says.

“I would expect future reports to see even more representation from the REITs.”

The Revista report also includes the top 50 medical real estate owners ranked by how much they grew their real estate portfolios through construction projects in 2016.

Leading the way was a not-for-profit system, St. Louis-based BJC Healthcare, which had construction vs. gross assets of 26.1 percent.

It was ranked No. 1 in the “Top Medical Real Estate Owners Ranked by 2016 Construction vs. Gross Assets” followed

by Sacramento-based Sutter Health, which had construction vs. gross assets of 18.5 percent.

Report reflects sector’s growth

Mr. Hargrave of Revista tells Healthcare Real Estate Insights™ that the HRE sector continues to grow at an impressive pace, especially among the top 50 owners.

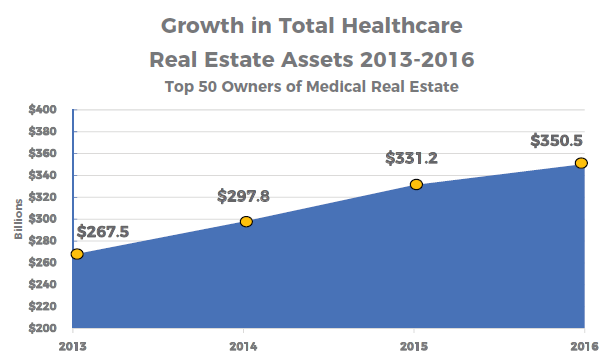

Since 2014, according to the newly updated Revista report, the top 50 owners, as a group, experienced total growth in their real estate holdings of 11.3 percent in 2014, 11.1 percent in 2015 and 6 percent in 2016.

According to Mr. Hargrave, all of the country’s hospital-related real estate should top $1 trillion in early 2018, with many professionals involved in the sector saying that the health systems still own an estimated 80 percent to 85 percent of the properties.

Those properties include hospitals, MOBs, cancer centers and surgery centers, with SNFs and other senior housing facilities not included in that figure.

“The healthcare systems themselves continue to grow and to build new facilities, and as a result their portfolios are growing and so are those of the REITs and other major owners,” Mr. Hargrave says.

The overall growth of the sector is also reflected by the higher prices and lower capitalization (cap) rates, or first-year returns, being paid for HRE facilities, he adds.

Here’s a look at some other highlights from Revista’s Top 50:

■ The top 50 entities on the list own about $350.5 billion worth of property at the end of 2016. That’s up substantially – about 31 percent – from the $267.5 billion owned by the top 50 owners in Revista’s first report, which included data from 2013.

■ The top 50 owners grew their real estate holdings by 6 percent from year end 2015, when the total was $330.9 billion.

“Of course, the data used to compile any list of this kind is constantly changing,” Mr. Hargrave notes.

“For example, the recent acquisition of most of the Duke Realty healthcare real estate portfolio by Healthcare Trust of America will have a sizable impact on the final rankings for this year.

“But we continue to track the data on an ongoing basis, and we’ll certainly have another update next year.”

Revista provides healthcare property and industry data, market reports and other resources, and hosts educational networking events, including its upcoming National Launch & Executive Forum Jan 29-30, 2018, in Biscayne Bay, Fla.

To access Revista’s complete “2016 Top 50 Owners of Medical Real Estate” report, and for other HRE data, as well as information on events, please visit RevistaMed.com.

Source: Company Filings, company data submissions and Revista Research. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on revistamed.com and with proper credit to Revista or Revistamed.com.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE