News Release: Just Closed – Valley Medical Plaza Portfolio

JUST CLOSED: VALLEY MEDICAL PLAZA PORTFOLIO The CBRE U.S. Healthcare Capital Markets Group acted as the exclusive advisor for the sale of the Valley Medical Plaza Portfolio in Van Nuys, California. Sale Date: September 19, 2017 Portfolio Size: 102,787 SF Occupancy: 98.7% (Valley Medical Plaza I) 96.9% (Valley Medical Plaza II) The CBRE U.S. Healthcare Capital Markets Group is pleased […]

TRANSACTIONS: Benedict Realty Group reportedly plans to add medical space to newly acquired asset

GREENWICH, Conn. – New York-based Benedict Realty Group (BRG) has reportedly acquired a Greenwich office building for $33.8 million and plans to convert some of the space for medical use, according to a July 18 article in the local Greenwich Time newspaper.

TRANSACTIONS: Hammes Partners II acquires MOB portfolio in Massachusetts; BGL represents seller

CHICOPEE, Mass. – The healthcare team with Cleveland-based Brown Gibbons Lang | Real Estate Partners (BGLREP) represented the seller of a three-MOB, 138,000 square foot portfolio near Chicopee, Mass.

Transactions: Joint venture of USAA and HSA PrimeCare acquires MOB in northwest Minneapolis suburb

PLYMOUTH, Minn. – An equity investment fund comprising San Antonio-based USAA Real Estate and Chicago-based HSA PrimeCare recently expanded its portfolio with the acquisition of a 45,722 square foot medical office building (MOB) in a highly trafficked commercial area of Plymouth, a Minneapolis suburb.

TRANSACTIONS: Velocis acquires value-add MOB complex in San Antonio; JLL represented the seller

SAN ANTONIO – Legacy Oaks, a seven-building, 224,262 square foot medical office complex next to South Texas Medical Center in San Antonio, has been sold.

TRANSACTIONS: Griffin-American REIT IV buys CHI-anchored surgery center in Oregon for $23.2 million

ROSEBURG, Ore. – Irvine, Calif.-based Griffin American Healthcare REIT IV in late June acquired the three-story, 62,246 square foot Roseburg Surgery Center in southwest Oregon for $23.2 million, or $374 per square foot (PSF), according to data from Real Capital Analytics (RCA).

TRANSACTIONS: Global Medical REIT pays $49.5 million for Oklahoma City facilities; BGL brokers sale

OKLAHOMA CITY – Three facilities in Oklahoma City that are home to services provided by the Oklahoma Center for Orthopaedic & Multi-Specialty Surgery recently traded for $49.5 million, according to data from RCA.

TRANSACTIONS: MOB in Escondido, Calif., trades hands for $21.85 million; Fairfield advises

ESCONDIDO, Calif. – Denver-based Fairfield Advisors facilitated the $21.85 million sale of Citracado Plaza MOB in Escondido, Calif., north of San Diego.

CAPITAL MARKETS: Spotlight on JLL Capital Markets

Mindy Berman imparts her MOB knowledge and gives a market update By Erik Tellefson As part of my Capital Markets column – and in an effort to share thoughts on the healthcare real estate market from diverse viewpoints – I’ll be featuring commentary from some of my colleagues in the medical office community. This month, I spoke with Mindy Berman of JLL. […]

TRANSACTIONS: JLL handles sale of 77,825 s.f. Clearfork MOB on Texas Health hospital campus in Fort Worth

FORT WORTH, Texas – The Clearfork MOB, a fully leased, 77,825 square foot facility in Fort Worth, traded hands, the Healthcare Capital Markets Group with Chicago-based Jones Lang LaSalle Inc. (NYSE: JLL) announced July 17. The price was not disclosed, nor were the buyer and seller.

News Release: Healthcare Executive Andrew Hoover Joins Meridian as Vice President of Business Development

FOR IMMEDIATE RELEASE: Contact: Anne Monaghan Andrew Hoover Monaghan Communications Meridian 830.997.0963 […]

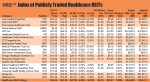

REIT REPORT: HCP makes changes at top, again

Some market observers are bullish on REIT’s outlook as it shores up its portfolio By John B. Mugford Changes in the executive leadership team at Irvine, Calif.-based HCP Inc. (NYSE: HCP) have been a way of life at the healthcare-focused real estate investment trust (REIT) for more than a year now. The REIT has also been making efforts to shore […]

TRANSACTIONS: Anchor Health and Physicians Realty Trust acquire MOB

HUNTSVILLE, Ala. – Wilmington, Del.-based Anchor Health Properties announced Aug. 8 that it has sourced and closed, with an equity partner, the Clearview Cancer Institute (CCI) MOB in Huntsville. The three-story, 112,500 square foot off-campus MOB is home to CCI’s operational headquarters in the Huntsville market and features two linear accelerators and multiple oncology bays.

TRANSACTIONS: HR Trust making $612.5 million buy

The seller of the portfolio is a sector pioneer, Atlanta-based Meadows & Ohly By John Mugford A quick perusal of the list of 15 medical office buildings (MOBs) that Atlanta-based Meadows & Ohly is selling to a large healthcare focused real estate investment trust (REIT) indicates how many health system relationships the long-time development firm has established over the years. Since its founding […]

COVER STORY: Top 50 Owners of Medical Real Estate

Data firm Revista releases most recent Top 50 owners report. Health systems still dominate and Kaiser is still the king. By John B. Mugford As has been the case for each of the past four years, the king of healthcare real estate (HRE) remains, according to a new report, Kaiser Foundation Hospitals, part of Kaiser Permanente, the massive […]