Promising Q3 and Q4 data bodes well for the coming year, firm’s report finds

By Erin E. Porter

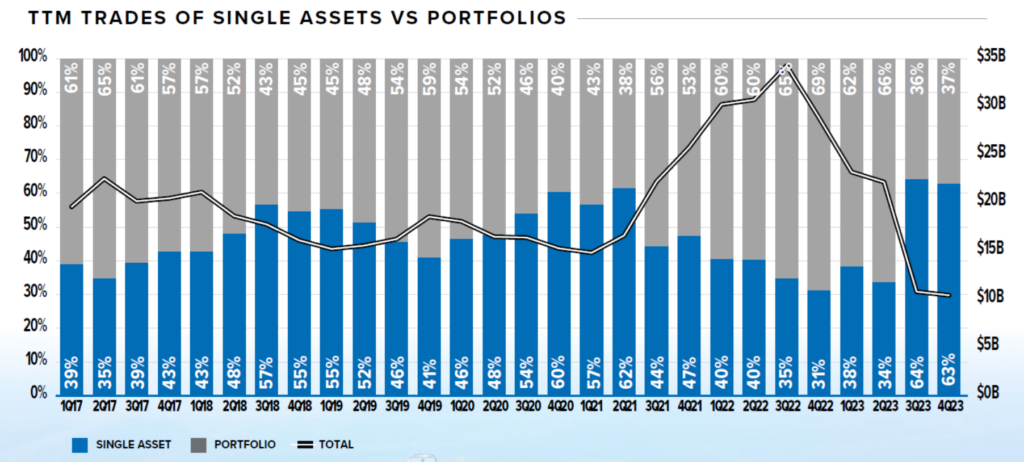

The Newmark report found that a decline in portfolio volume was the largest driver of reduced MOB sales in 2023, as portfolio trades decreased to only 37 percent of the total dollar volume of sales. Portfolios typically account for closer to 55 percent. (Chart courtesy of Newmark)

Although last year was not the best for the healthcare real estate (HRE) business, the sector’s resiliency and strong fundamentals during the second half of the year portend hope for 2024, according to the recently released “2023 Medical Outpatient Building (MOB) Sector Year in Review” from Newmark Group Inc. (Nasdaq: NMRK).

The report, compiled by John Nero, senior managing director, Newmark Healthcare Capital Markets, outlines the trends and drivers throughout the year and their effect on the HRE space. In addition to sharing news of the report, HREI™ had a chance to get additional insights from Mr. Nero.

Despite some forecasts and predictions, an economic recession never materialized in 2023, as positive trends in the U.S. economy, such as “strong consumer spending, robust and steady job growth, growing real wages, and real GDP (Gross Domestic Product) growth” helped to right the ship by the second half of the year.

Digging into the items that have staved off that recession, the report notes that

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE