Revista webcast suggests that leading indicators are promising for LSRE

Some recent data about life sciences and life sciences real estate (LSRE) shows encouraging signs, according to the speakers during this week’s Revista’s market update webcast. (BREI photo)

NATIONWIDE – Faced with a challenging life sciences real estate (LSRE) market with no clear end in sight, it’s understandable that many industry professionals are worried – especially Millennials who haven’t been through this kind of slowdown before.

Fortunately, both history and hard data suggest that things will get better.

That was the encouraging message from the speakers who shared their insights and data Tuesday (Nov. 7) during Revista’s first LSRE market update webcast. Joining Revista co-founder and principal Hilda Martin were Elizabeth Berthelette, head of National Life Science Research for Newmark Group Inc. (NYSE: NMRK), and Murray W. Wolf, publisher and founding editor of Healthcare Real Estate Insights (HREI) and Bioscience Real Estate Insights (BREI).

Arnold, Md.-based Revista, with its RevistaLab and RevistaMed services, provides industry and real estate data for the healthcare and life sciences sectors.

“We are so excited to have this first life science update webcast,” Ms. Martin began. “If you’re familiar with Revista, you know we do the quarterly med webcast, and we have for a number of years. But this is our official market update for life science.”

She then introduced Mr. Wolf, who has more than 40 years of experience in marketing and media, primarily in the commercial real estate industry. He had some heartening words for the webcast listeners.

“I don’t mean to be overly sanguine about the state of the market. I know it’s very difficult out there. It’s very challenging in life sciences real estate for a lot of reasons that we’ll be talking about in the next hour or so,” Mr. Wolf began.

“But what gives me comfort is, as Hilda mentioned earlier, those of us who have been around for a while, we’ve been through this kind of thing before. And when you’re a good business with strong fundamentals – demographics and real estate fundamentals – there are going to be difficult times but, long-term, this is still a great business to be in.

“So if you’re able to continue to execute on your strategy, be persistent in your work over the next, I don’t know, 12, 18 months as we kind of ride this out, and be patient and prudent, ultimately you’re going to be just fine. So for those of you who might be a little younger, who haven’t had to endure something like this, I hope those are some words of comfort…”

First the bad news

Mr. Wolf then introduced Ms. Berthelette of Newmark, “a seasoned commercial real estate research veteran and … an economist with 17 years of experience providing insights into (not only) the Greater Boston market, but also the national life sciences landscape.”

Ms. Berthelette began, “As Murray mentioned, we are going to talk about and focus on some of the challenges that the life science sector is facing. So I’m going to cover what I would consider to be major demand drivers – employment, funding, public markets, all of those things.

“So, there again, there are challenges that the marketplace is facing, but I think we’re starting to see some more positivity in the data. There’s definitely some green shoots…”

But first the bad news. As Ms. Berthelette acknowledged, “Those macroeconomic headwinds that we’ve been talking about, they’re persisting into 2023.” She noted that the number of biotech company bankruptcies – 28 so far this year – is at a 10-year high, and more biotech firms (138) have already announced layoffs this year than all of last year.

“So what’s really driving this activity? Companies are struggling to secure financing and recover financially,” she explained. She said the “root cause” of the financial issues these companies have been facing is “this higher interest rate environment” and the post-COVID “economic turmoil.”

She added, “And, since the pandemic, more biotech companies have been willing to take on debt, which I think has also resulted in some of the issues with bankruptcies.”

Ms. Berthelette noted that bankruptcies and layoffs tend to go hand in hand. In addition, she said, active job openings in the sector continue to decline. The number of closed job ads is outpacing new ad listings within the biotech industry for a second consecutive year.

“We can see that we had a bit of an uptick in openings, which was a positive, earlier this year. However, given the way that the market has played out throughout the rest of 2023, the number of active job openings related to the biotech sector has continued to decline over the last several months,” she noted. However, demand for workers with advanced degrees has remained relatively high.

Positive signs for employment and funding

On a more positive note, Ms. Berthelette, continued, “Despite all of the headwinds that I just talked about, we’re still seeing positive job growth” in the life sciences industry. Although the growth rate is slowing, she acknowledged, “we’re still seeing a lot of positive momentum in the job market. Over the last five years, cumulatively, we’ve seen well over 20 percent employment growth in the life science sector, which equates to somewhere near 475,000 jobs across the U.S. So that’s a significant number, and certainly something that we’re keeping an eye on.”

Although employment growth has been slower this year than during the pandemic, when funding was pouring into the life sciences industry, she said, “I think, on average, we’re still seeing positive job growth month over month in the life science sector.” That growth is even greater for research and development (R&D) jobs, she added.

She noted that life sciences employment growth “is slowing, or normalizing, but we’re still seeing positive gains across the top four markets” – the largest life sciences clusters of Greater Boston, San Diego, the San Francisco Bay Area and the Research Triangle of North Carolina, “although we’ve seen growth and more emergent markets…

“Now,” Ms. Berthelette said, “I want to switch gears and talk about funding… because, in general, more funding usually leads to a greater need for commercial real estate, as well as job growth and all of those kinds of things.”

She noted, “As of October 2023, VC (venture capital) funding was only about 14 percent below 2019 levels and has already surpassed annual capital raised prior to 2018.” Year-to-date (YTD) VC funding has been about $20.1 billion, she said, “certainly slower than ‘21 and ’22, which, arguably… we may never see those levels of funding for several more years, if ever. But if you sort of look pre-COVID, before 2020, we’re not that far off” from the pre-pandemic total of $23.4 billion in 2019.

She added that while the number of VC deals is still well below historic norms, the average funding round has reached a 10-year high.

“So (the data is) indicating that the average round of funding is much larger,” she said, which is “indicating, or potentially indicating, that there’s sort of a flight to quality amongst venture capitalists, or risk aversion, and the venture capitalists are really taking the funding, the funds that they are deploying, and putting them into companies that they think would be most successful.”

Ms. Berthelette also noted that VC funding has increased every quarter this year, rising to $7.1 million in the third quarter (Q3) – more than the pre-pandemic quarterly totals.

“I think this points to some positivity, or maybe a potential turning point in funding,” she said. “And while it may take a couple of quarters, or maybe even more than a couple of quarters, for this to translate into new real estate demand… it’s certainly something to note that we are seeing more funding in line or better than what we saw prior to COVID on a quarterly basis.”

She also noted that although all forms of VC funding are down from peak 2021 levels, series A and B rounds of funding – investing capital in growing companies that are beyond the start-up stage – continue to dominate, accounting for more than half of all funding.

Next, she mentioned, “Capital raised by venture funds has improved significantly in 2023, expanding by 47 percent over 2022 levels.” With more “dry powder” waiting on the sidelines, she said, VC funding in the life science sector could continue to improve in the coming quarters.

“It’s something that we’re keeping track of and looking towards as may be an indicator that there’s potential growth on the horizon,” she said.

How long until we see a rebound?

Mr. Wolf of BREI then asked how long it will take for the improvement in these leading indicators to result in a tangible increase in LSRE demand.

“That is a very good question,” Ms. Berthelette replied, “and I think in a post-COVID environment it may be more difficult to tell. Historically, I think you could argue that (a recovery could take) maybe 6 to 12 months, or maybe some of these companies are signing leases in anticipation of getting funding rounds. We’ve seen that in the past.

“During COVID, obviously, there was a lot more immediacy. You get funding, you really needed to grow and move and expand. In this current environment, I think we’ll see a lot more cautiousness, even though there’s capital being raised (and) companies are receiving funding. They may be slow to expand their footprint. They may be slow to hire. They want to extend their cash runway so that they can ensure they’re able to continue to move the science forward. So I think I don’t have a great answer for you, but I think going forward it might take a little longer, just given where we are in the cycle.”

Ms. Berthelette then discussed the number of initial public offerings (IPOs) for biotech companies. She noted that 2022 and 2023 YTD have seen the fewest biotech IPOs in the past 11 years. However, the average deal size has been increasing, again perhaps signaling a flight to quality.

“Investors will likely remain focused on the highest-quality companies to avoid downside risks,” she said.

Conversely, the 95 secondary offerings so far this year are the most since at least 2013, she said, “which I think makes sense, given that companies are again looking to extend their cash runways – you know, increase capital, infuse capital into their companies as challenges have arisen.”

Another positive sign, she continued, is that federal funding of the life sciences was $43 billion last year – the highest level ever. That is predominantly National Institutes of Health (NIH) funding.

“I think it’s really important to… talk about the NIH and the federal investment into the life science sector as it is a very important part of the ecosystem,” she said. “So it’s not only the venture capital funding and the private sector and the private R&D. The NIH funding is very important for the institutions,” namely research universities and academic medical centers.

There’s also a new NIH program called Advanced Research Projects Agency for Health (ARPA-H), she said.

“I don’t think we know the full extent of the impact of this new program,” she said. But the program has already selected three regional “hubs” and a number of other “spokes,” a presence that will boost life sciences activity in those markets.

One last positive leading indicator, Ms. Berthelette said, is the growing number of U.S. Food and Drug Administration (FDA) clinical trials and new drug approvals. The 64 new drugs approved this year are the most ever.

In closing, Ms. Berthelette emphasized that the most successful life sciences clusters and LSRE markets are those that provide an “ecosystem,” including: universities that spin out talent, new technologies and new companies; top research hospitals; supportive local government and economic development agencies; and enough real estate with established owners and operators to support their needs.

In addition to the four largest clusters mentioned earlier, she said, “We’re seeing growth in places like Boulder (Colo.), Houston, Dallas, Chicago, and they all have many components of the ecosystem that I just talked about. I think it’s early days for a lot of these markets, but we’re seeing a lot of investment into places like Dallas and Houston, and as I mentioned Boulder, and a few others. And I think we’re several years out from those markets kind of competing with where the top clusters are as established life science hubs, but there’s certainly room for more growth and room for dispersion of growth amongst more markets.”

428 million square feet of LSRE

At that point, Ms. Martin of Revista launched into her part of the presentation. After sharing a bit of background on Revista’s 10-year history and its more recent expansion into LSRE, she noted that the firm is currently tracking about 428 million square feet of existing and under-construction life sciences facilities.

Mr. Wolf pointed out that Revista’s total market inventory figure of nearly 430 million square feet is greater than other sources. Ms. Martin said that’s because Revista includes all life sciences properties, not only investor-owned space.

“We want to be comprehensive… So your pharmaceutical firms, your life science firms, your universities, government – we will include all of that inventory,” she said. That also includes manufacturing facilities and “mixed” properties that aren’t 100 percent life sciences.

Turning to the data, Ms. Martin noted that third-party investors own about 55 percent of the roughly 350 million square feet of existing LSRE. Life sciences and pharma companies own 31 percent, real estate investment trusts (REITs) own 22 percent and hospitals, universities and governments own 12 percent.

“So you’ve got over half of the inventory owned by a third party,” she observed, “and if you looked at just those top three clusters, this becomes really pronounced, because more than three-quarters of inventory in those markets is investor-owned.

“So there’s a much greater prevalence of investor-owned inventory in some of those key market clusters. Then, once you get outside of those clusters, outside of the top three, it’s actually more user-owned inventory.”

With respect to the roughly 80 million square feet of LSRE now under construction, Ms. Martin said that private investors are responsible for 48 percent, REITs 26 percent, large science and pharma companies 16 percent, and hospitals, universities and governments 10 percent.

“So we’ve got 80 million square feet that’s currently broken ground and underway across the U.S. of life science inventory… Almost half of that actually falls within those three top markets, so it’s a significant portion is focused on those three,” she said.

“But this is looking at the ownership across all of it, and it’s very investor-driven. So this also is about three-fourths investor-developed and owned inventory that’s going to be coming to market in the next couple of years.”

Ms. Martin then showed a chart of the 10 most active developers in terms of square feet under construction. Alexandria Real Estate Equities Inc. (NYSE: ARE) topped the list with 5.9 million square feet, followed by IQHQ, Biomed Realty, Lane Partners, Beacon Capital Partners, King Street Properties, Boston Properties (NYSE: BXP), WuXi AppTech (OTC: WUXAY), Trammell Crow Company and Longfellow Real Estate Partners.

“This is just what’s currently underway… and these top 10 developer-owners represent 35 percent of everything that’s underway,” she said.

Construction starts have been dropping

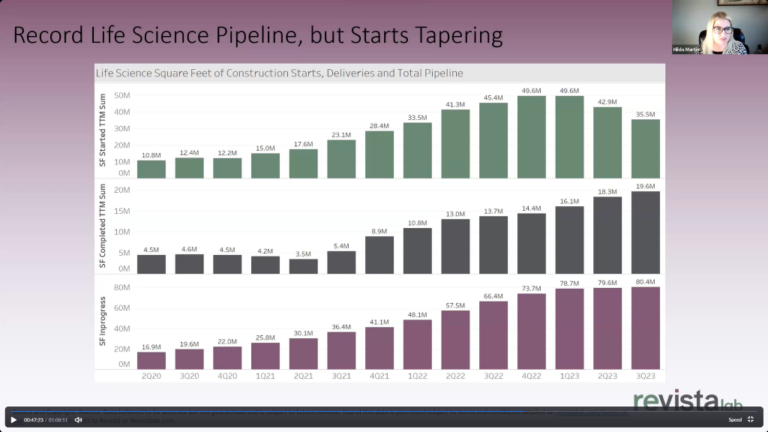

Ms. Martin noted that a record amount of LSRE is under construction, but the pipeline is starting to taper off. Quarterly completions have been rising each quarter this year, but quarterly construction starts have been dropping steadily. Projects in progress have leveled off, to about 80.4 million square feet during Q3.

“There’s a pretty big pull-back in starts as of 2023… Things are starting to catch up a little bit,” she said. “At the peak, in late ‘22, we were running almost 50 million square feet breaking ground on an annual basis, ongoing, so just significant amounts of new starts.”

This year, she said, “we’re definitely starting, going to see a big pull-back in starts. So as that pipeline starts to empty a little bit, the total pipeline will contract.”

Mr. Wolf asked how much of the square footage in the pipeline was for conversions of existing buildings versus ground-up new development.

“Conversions are a big chunk of inventory in specific locations,” Ms. Martin said. “I’d say Boston is number one. In fact, about a quarter of the projects we’re tracking that are underway in the Boston metro are conversions versus ground-up. There are also quite a few in San Diego, and some in San Francisco. You see it a little less as you get away from some of those high barrier-to-entry markets…

“So another way, another visual, of looking at this, we’ve got 24 percent of inventory currently under construction. So when at the end of the day when all this stuff opens, it’s going to push the total inventory up to almost 430 million (square feet). It’s going to be a big uptick.”

Ms. Martin then shared a slide stating that the top three markets have increased occupied space by 10 million square feet since Q1 2022.

“I’m showing this because there’s a lot of talk about how much new inventory is coming online, but there’s still so much demand for space,” she said. “There’s 10 million more square feet occupied in these three markets in the third quarter of this year versus the beginning of last year, which is a huge amount of square footage. It’s almost 10 percent of inventory has been taken over.

“Now, with all the new stuff opening, there’s certainly some impact on overall occupancy. We’re currently at 91.6 percent. We’re down about 100 basis points from a year ago. You keep going back to the beginning of ‘22, it’s more like 160, 180 basis points. There’s some impact. It’s going to vary greatly market to market and even submarket to submarket. So we’ll see a little bit of a dive coming up here.”

Mr. Wolf asked if the office portions of LSRE buildings are facing the same challenges currently being faced by traditional office space, where remote work and hybrid work have dramatically cut into occupancy.

“We’re not seeing any indication that there’s a big impact on life science for that office piece,” Ms. Martin replied. “There’s still a ton of demand for space. Workers have to come in to use the lab portion of the building and, certainly, that office is supporting that lab. So we haven’t seen any indication that we’re being impacted so much by that.”

Revista has heard anecdotally, she said, that some projects are reducing the ratio of office space to lab space.

“But from a standpoint of demand, most of these folks have to be in the building at some point for their functions.”

Tenants are being more cautious

Next, turning her attentions to life sciences rents, Ms. Martin noted that rents remain relatively high, with the national average at $62.29 per square foot (PSF) as of Q3, down only 4.3 percent from the peak of $65.11 PSF in Q4 2022. But tenants are being more cautious about their space needs. Rents and absorption have declined since Q4 2022, “so it looks like tenants are showing a little bit more caution just in terms of total space that they’re taking on in the current environment,” she said.

She then shared a slide showing new inventory under construction as a percentage of existing inventory. In the Greater Boston market, it is more than 23.7 million square feet, equal to 40.6 percent of current inventory. The percentages were nearly as high in some of the other top clusters.

As the webcast neared a conclusion, Ms. Berthelette of Nemark said her firm continues to be “very bullish on Boston” despite all the new product in the pipeline.

“It is the epicenter of life science globally,” she said, “and almost no market will probably ever surpass Boston, given how long we’ve been at the top and just the level of maturity in our life science ecosystem. It’d be very, very hard to compete.”

She acknowledged “that there’s some supply that’s mistimed, which can happen in real estate cycles, and we’ve seen it in other asset types. You’ve seen it in other markets… But, overall, (we’re) very bullish and Boston will always be the top life science hub.

Ms. Martin of Revista noted that there are “haves and have-nots when you get down to the sub-market level” in Boston. There is almost no space available in East Cambridge, for example, but some suburban sub-markets face some leasing challenges.

“This is true in San Francisco as well…,” she said. “There was bumpiness last year, in ‘22, a couple quarters of a little negative demand. But this year it’s been very strong. The market’s been absorbing new inventory coming online. In fact, there was a slight uptick in occupancy in the third quarter.”

She continued, “San Diego overall has had a little bit of negative absorption in the past couple of quarters after a pretty strong start to the year. So it’s been a little bit bouncy, a little bit mixed in this metro area. You’ve seen occupancy come down a little bit.”

To learn more about Revista and other upcoming life sciences conferences, please click here.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE