Q3 data from Revista indicates occupancy rates and demand for space are strong

By John B. Mugford

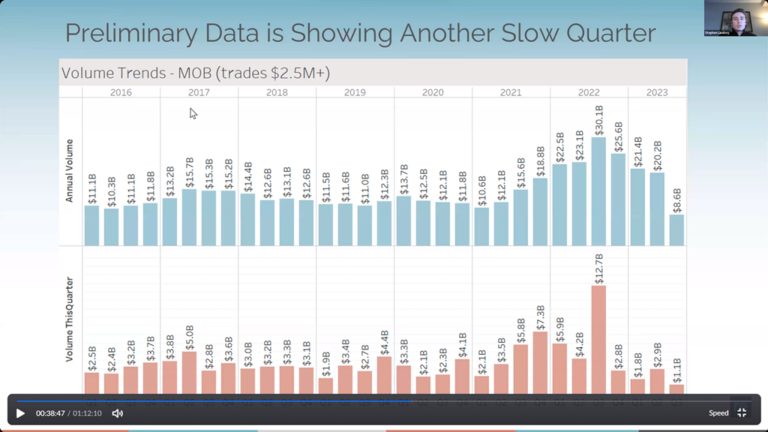

Preliminary data indicates that MOB sales volume is down 74.6 percent during the first three quarters of this year compared with the same period last year. (HREI photo)

As noted in a short report in last week’s edition of HREI, medical office building (MOB) sales volume in the third quarter (Q3) was $1.1 billion – the lowest quarterly dollar volume since Revista began compiling such information in the first quarter (Q1) of 2016.

When combined with the MOB sales volume of $4.7 billion in the first half of the year, the preliminary total through three quarters stood at $5.8 billion. Although Revista says those numbers are preliminary and will probably increase somewhat as additional transactions are uncovered in the coming weeks, that is down 74.6 percent from the first three quarters of 2022, when the volume was $22.8 billion on its way to a yearly record of $25.6 billion.

Revista Research Analyst Stephen Lindsey conveyed that sobering information during the Arnold, Md.-based healthcare real estate (HRE) research firm’s third quarter (Q3) subscriber webcast Oct. 19. Also on the webcast to provide data and insights were: Mike Hargrave, RevistaMed principal; Mindy Berman, senior managing director of the Capital Markets team with Jones Lang LaSalle Inc. (NYSE: JLL); and Troy Freeman, VP of real estate management with Phoenix-based Banner Health.

Despite the historically low sales volume so far in 2023, much of the other data presented during the webcast indicated that the HRE sector remains strong and that it is a good place to be in business for investors, facility owners and others.

As an example, Mr. Hargrave opened the webcast showing

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE