All asset classes will see distress, but healthcare probably won’t see much

By John B. Mugford

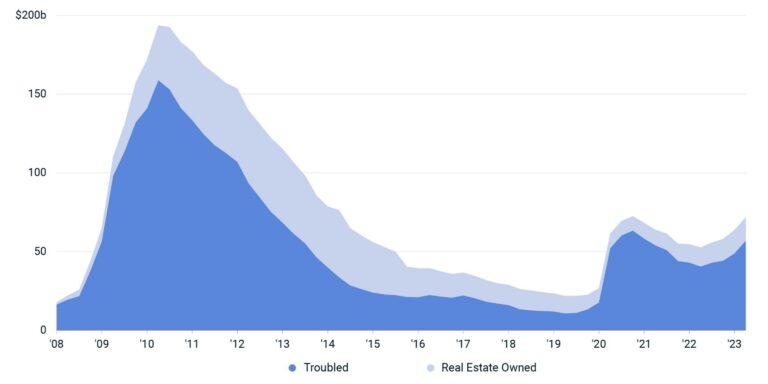

Data from MSCI Inc. indicates that the number of distressed properties has increased significantly during the past year. This graph shows the totals across all commercial real estate asset classes. (Chart courtesy of MSCI)

Nearly $72 billion in U.S. commercial real estate (CRE) was considered “distressed” as of the end of the second quarter (Q2), an increase of 15 percent versus Q1, and another $162 billion of properties were considered to be in potential distress, primarily due to rising vacancy rates, higher debt costs or both.

The data cited above is from a report released July 19 by MSCI Real Assets, the investment analysis service of the New York-based finance company MSCI Inc., which considers distressed properties to include both financially troubled assets and assets taken back by lenders. The office sector had the most properties in financial trouble, accounting for $24.8 billion of the total. Retail properties were a close second with $22.7 billion of distressed properties, followed by hotels at $13.5 billion.

It’s no surprise that office buildings account for the largest dollar value of distressed properties. We’re all well aware of how the post-COVID-19 shift to remote work has adversely affected space demand, lease renewals and vacancy rates.

But properties across all asset classes – not only office – face another major challenge: Low fixed-rate CRE loans are coming due for refinancing at a time when property owners are facing much higher interest rates and tighter credit. According to a Morgan Stanley report from early this year, $1.5 trillion in CRE loans will be due before the end of 2025. That “refinancing cliff” could lead to a wave of distressed properties, industry experts say.

But what about healthcare real estate (HRE)? The owners of medical office buildings (MOBs) and other healthcare properties presumably face the same refinancing challenges.

To explore that question, HREI™ contacted several HRE professionals to garner their thoughts on the potential for trouble in the CRE sector – and whether that trouble could spill over into HRE.

Todd Kibler, managing principal who leads the investment and financing activities for Milwaukee-based Hammes Partners, said

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE