Economist Sam Chandan notes that Fed is likely putting an end to interest rate increases

By John B. Mugford

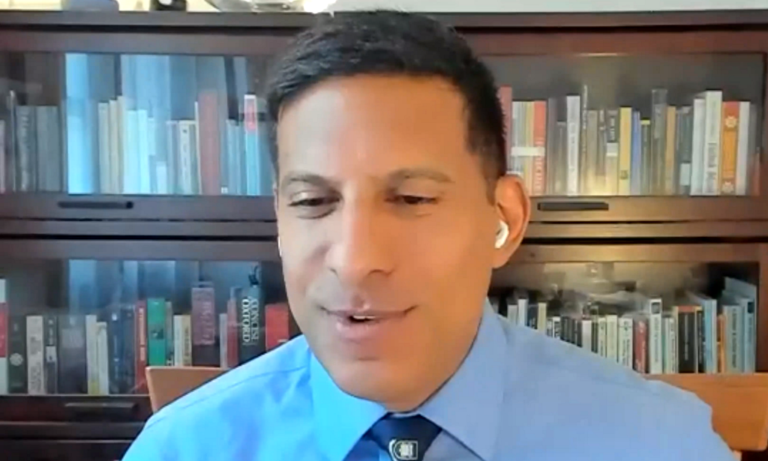

“This does not look like an economy on the cusp of a traditional recession,” economist Sam Chandon says. (HREI photo)

As you probably know, President Joe Biden and House Speaker Kevin McCarthy reached a tentative agreement over the Memorial Day weekend to raise the national debt ceiling, and Congress is scheduled to take up the plan today. Although approval is not assured, if both chambers of Congress vote to raise the debt ceiling, the United States will avoid defaulting on its debts by June 5, when the Treasury is projected to exhaust its ability to pay its obligations.

Yet some damage has already been done to the United States and its reputation even with a resolution, according to economist Sam Chandan, a Ph.D. and professor of finance and director of the Center for Real Estate Finance at the NYU (New York University) Stern School of Business. He is also the founder and non-executive chairman of Chandan Economics.

If the debt ceiling issue is not resolved, “our debt markets would be significantly more chaotic, our measures of financial stress in the system would also convey a fair degree of strain,” Mr. Chandan said May 23 during a webcast focused on the economy. The event was hosted by Arnold, Md.-based Revista, which compiles and provides a wide range of healthcare real estate (HRE) and life sciences real estate (LSRE) data for its subscribers.

“The second point … I want to emphasize on this is that

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE