Headwinds are likely to slow activity, but the need for projects will remain strong

By John B. Mugford

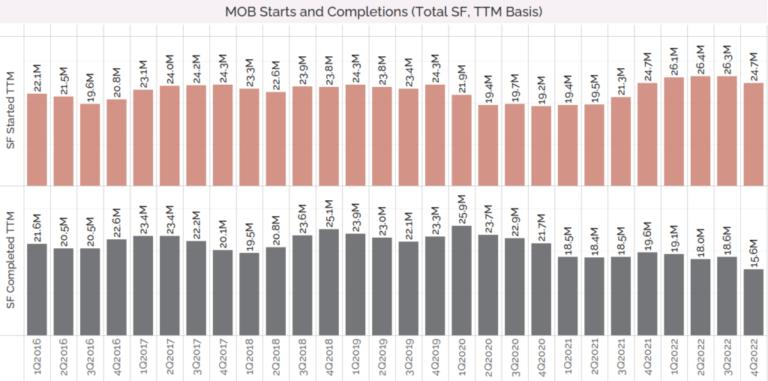

Although Revista found that construction starts and completions were both down during the fourth quarter (Q4) of 2022 vs. Q3, the annual volume of starts still exceeded pre-pandemic levels. (Chart courtesy of Revista)

With so many economic headwinds facing almost all business sectors, even the recession-resistant healthcare real estate (HRE) sector, why is a group of development professionals involved in the HRE space remaining so optimistic?

Both medical office building (MOB) sales and development are supposedly going to see a slowdown in coming months, in large part because of rising interest rates, difficulties in obtaining debt, increasing construction costs, a labor shortage and other factors. A recent fourth quarter (Q4) 2022 update from the HRE research firm Revista indicated that MOB construction starts were down about 6 percent in Q4 vs. Q3, and completions were down 16 percent.

Yet Revista pointed out that construction starts for the trailing 12 months were still ahead of pre-pandemic levels and the total pipeline of about 51 million square feet of medical office space in development is “a recent high watermark.” And a contingent of developers who conducted a panel discussion during a recent HRE conference said they are finding opportunities and looking optimistically to the future.

“Most of our development activity is still moving forward,” said Burney Dawkins, senior VP of investments with Nashville, Tenn.-based Healthcare Realty Trust Inc. (NYSE: HR), a publicly traded real estate investment trust (REIT) that is mostly focused on acquiring MOBs but which has an active development platform as well.

“I’d say maybe 20 percent of (our development projects have) been delayed because of the pricing that we’re seeing today,” he continued. “But in general, the activity’s there, demand seems to be there. We’re just dealing with the problem of how do we finance it? How do we capitalize these projects and what is the ultimate pricing going to be for the end user? So that’s where we are today. We’re working through it.”

He added that HR remains optimistic “that we’ll get through this period. And the good thing is

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE