JLL Healthcare Capital Markets

Healthcare Perspectives

October 2022

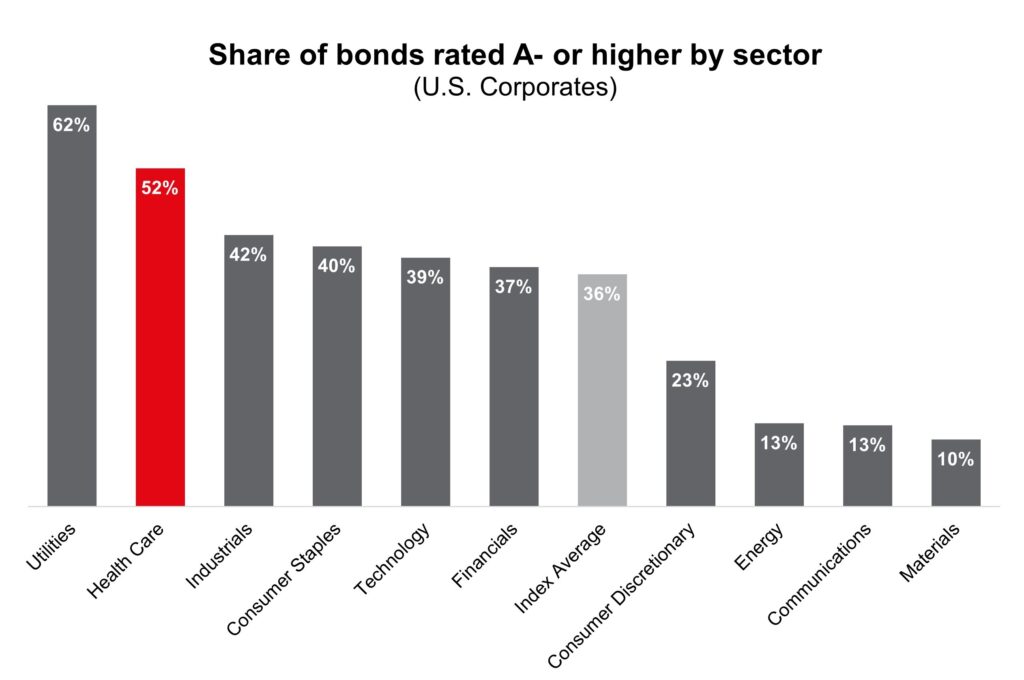

The healthcare sector tenant base is amongst the most creditworthy of any sector

Note: Among constituent bonds of the Bloomberg U.S. Corporate Aggregate and High Yields Indices

Note: Among constituent bonds of the Bloomberg U.S. Corporate Aggregate and High Yields Indices

Source: JLL Research, JLL Research, Bloomberg Finance L.P.

Key points:

• The healthcare sector offers one of the highest credit qualities of tenancy overall with a median credit rating of A-, considered a high investment grade rating. At this rating level, health systems produce consistently strong operations and cash flow, which are fundamental to meeting their payment obligations, such as rent, in full and on time. Healthcare providers benefit from reliable demand for healthcare services, regardless of economic cycles, and predictable reimbursement from diversified commercial and government sources, which themselves possess high credit qualities. These factors put health systems and physicians in an exceptional position to pay rent, which is typically less than 5% of overall expenses. Few industries can boast the level of certainty with respect to rent collections as the healthcare sector with historically rare credit defaults.

• More than three-quarters of U.S. health systems are not-for-profit or government-backed enterprises, accessing different sources of capital than for profit enterprises. Not-for profit systems rely on cash flow from operations, philanthropy, and new bond issues. In order to access the bond market, not-for-profit hospitals must maintain modest leverage, supported by high cash and investment balances to achieve rating levels, as opposed to for profit corporates with access to private or public equity markets and bond and bank markets, whether investment grade or below investment grade. As a result of this liquidity, hospitals rated A or better exhibit cash and investment holdings of 1.75 times outstanding debt for the median credit rating of A-, a rating level higher than most large corporates closer to BBB on average.

• In a changing and unpredictable economic environment, healthcare providers as tenants are highly valued by landlords, whether in medical office buildings, retail locations or other commercial office buildings. The proof statement for the defensive nature of healthcare tenants and their ability to consistently pay rent was evidenced in 2020, during the first year of the pandemic, with landlords reporting 99% or better collections from healthcare tenants. This reliability of rent payment, allowing landlords to meet their own payment obligations, makes healthcare providers very desirable tenants. The attractiveness of this profile bolsters the argument for medical office as a prime defensive asset class in the face of potential economic uncertainty.

Recent Activity

Closed – Financial Advisory

Anchor Health Properties platform recapitalization by foreign pension separately-managed account advised by StepStone. JLL Securities Mergers & Acquisitions Team acted as exclusive financial advisor to Anchor.

• $200m total equity commitment

• Acquisition of non-controlling common equity interest in platform operating company providing platform balance sheet strength and funding for select future investments

• Anchor’s current capital relationships and related investments not impacted – Anchor will continue to work with those valued partners

Read more >>

New Listing – Investment Sale

Northwest Phoenix Medical Office Portfolio

158,551 s.f.

Phoenix Metro, AZ

New Listing – Investment Sale

Highlands Ranch I & II

153,585 s.f.

Denver, CO

New Listing – Investment Sale

Utah On-Campus MOB Portfolio

85,056 s.f.

Salt Lake City Metro, UT

New Listing – Investment Sale

3838 California

82,805 s.f.

San Francisco, CA

View listing >>

Closed – Investment Sale

Kindeva Drug Delivery

137,811 s.f.

Woodbury, MN

Closed – Investment Sale

Foxhill Medical Office Building

52,161 s.f.

Overland Park, KS

Closed – Investment Sale

Fresenius Dialysis Centers

31,780 s.f.

Berwyn, IL; Columbia, SC; Roanoke, VA

Closed – Investment Sale

Advocate Health Six Corners

21,370 s.f.

Chicago, IL

Closed – Investment Sale

UC Davis Rancho Cordova

18,482 s.f.

Rancho Cordova, CA

To learn more about JLL’s 2022 Life Sciences Research Outlook & Cluster Rankings, click here: 2022 Life Sciences Research Outlook

Healthcare Capital Markets Contacts

Healthcare investment sales & advisory contacts

East

Mindy Berman

Senior Managing Director

+1 617 316 6539

mindy.berman@am.jll.com

Ted Flagg

Senior Managing Director

+1 917 215 7036

ted.flagg@am.jll.com

Brannan Knott

Managing Director

+1 617 316 6508

brannan.knott@am.jll.com

Central

Brian Bacharach

Senior Managing Director

+1 214 438 6462

brian.bacharach@am.jll.com

West

Evan Kovac

Senior Managing Director

+1 206 336 5439

evan.kovac@am.jll.com

Andrew Milne

Senior Managing Director

+1 858 812 2370

andrew.milne@am.jll.com

Matt DiCesare

Director

+1 310 407 2149

matt.dicesare@am.jll.com

Healthcare debt advisory contacts

East

Anthony Sardo

Director

+1 617 531 4198

anthony.sardo@am.jll.com

Central

Timothy Joyce

Managing Director

+1 312 528 3652

timothy.joyce@am.jll.com

West

John Chun

Managing Director

+1 949 798 4108

john.chun@am.jll.com

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE