Opinions vary, but most agree that debt costs are up and there’s a gap in bid-ask pricing

By John B. Mugford

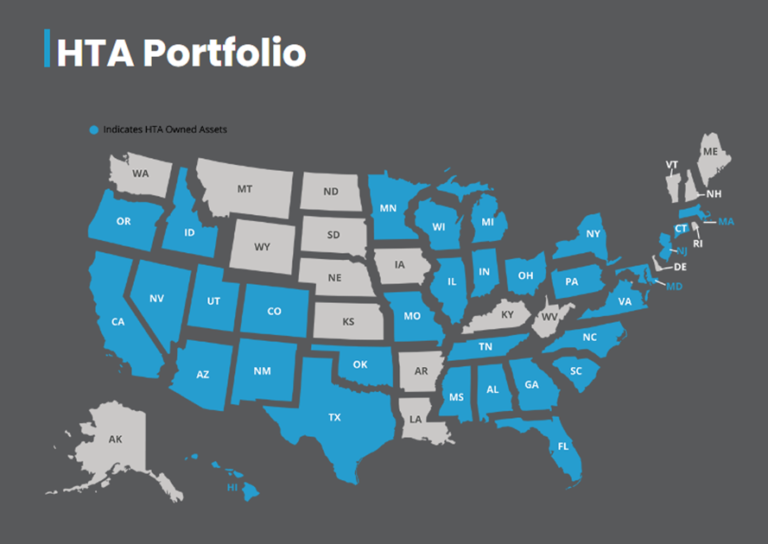

This year will probably set a record for MOB sales thanks to the roughly $11 billion HR-HTA merger. But that mega deal might mask a possible slowdown in overall deal volume during the second half of 2022. (Illustration courtesy of HR)

Sure, medical office building (MOB) sales have been on a tear in the 12 months leading up to the end of the second quarter (Q2) of this year, totaling an all-time high of $21.2 billion during that time.

And, by the time 2022 comes to a close, the MOB sales volume for the year is likely to top the all-time, single-year record, largely fueled by this year’s merger of two of the sector’s largest publicly traded real estate investment trusts (REITs): Healthcare Trust of America (HTA) into a newly formed Nashville, Tenn.-based Healthcare Realty Trust Inc. (NYSE: HR).

That merger includes the sales of MOBs totaling about $11 billion – the final total has yet to be tallied by healthcare real estate (HRE) data firm Revista. When coupled with the first-half 2022 volume of $8.2 billion, those sales alone would top $19 billion. The was set in 2021 with a volume of $18.4 billion, according to Revista.

However, although sales have been strong and the HR-HTA merger will indeed propel 2022 to new heights, there is currently an underlying feeling among HRE professionals that

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE