JLL

Healthcare Capital Markets

Healthcare Perspectives

July 2022

Concerns about interest rate increases softening in near term

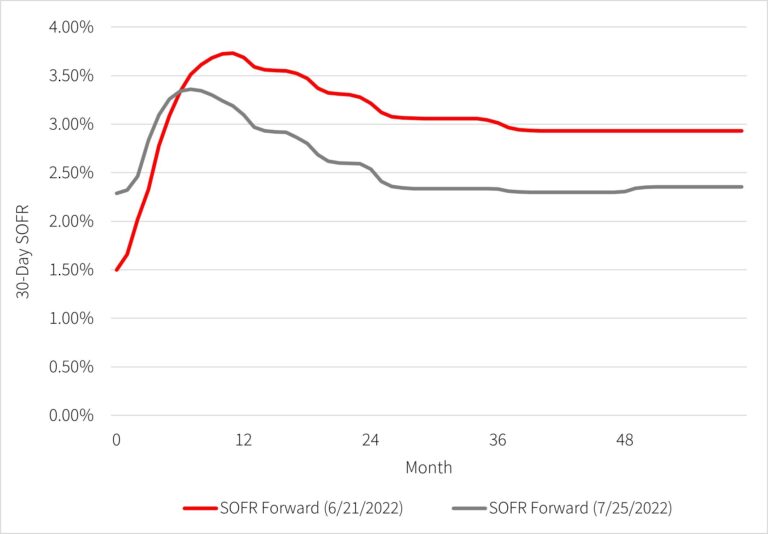

Change in the SOFR Forward Rate Curve

Source: Kensington Capital Advisors

Key points:

• Fears about mounting interest rates subsided with the Federal Reserve’s announced rate hike of 75 basis points on July 27, providing welcome relief for real estate investors and the cost of financing. Given the low rate environment that borrowers have enjoyed in recent years, with near zero SOFR and LIBOR rates, it’s amusing that a 75 basis point hike is taken as positive news. Regardless, dour market sentiment with inflation concerns following the last rate hike in June has since improved and is now reflected in lower rates in the forward SOFR curve, retreating 60 basis points from last month’s peak.

• For healthcare property loans, 5-year swap rates are the leading barometer of all-in fixed borrowing costs. Since the trough of rates in the market a year ago, 5-year swap rates increased over 250 basis points from July 2021 to a high of 3.15% in mid-June 2022, but have backed off to 2.60% today. Interest rate protection via SOFR caps have recently followed a similar positive trend, with a nearly 25% reduction over the past month.

• Healthcare property lending is dominated by balance sheet commercial bank lenders, representing greater than 90% share of new loans for medical office and hospital facilities, in contrast to other real sector sectors which are more dependent on securitized debt and life insurance company financing. Despite the increase in nominal rates, liquidity for healthcare lending remains high and lenders have been continuously active in underwriting new loans, including loans greater than $100 million. JLL’s observation, through its more than $1 billion annual healthcare loan volume, is that there are comparatively limited changes in offered terms and credit spreads in healthcare, relative to other sectors. Thus, commercial banks have provided a safe harbor for healthcare properties with their historically strong performance and virtually no loan losses. Rates are still at historically low levels which is another positive factor for real estate investment. The stability of healthcare lending means that medical office investment values are primarily impacted by higher nominal interest rates, which has resulted in lower upward pricing adjustment compared to other property sectors.

Click here for:

JLL Healthcare Debt Market Insights

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE