The complexities of the emerging sub-asset class are creating both challenges and opportunities for growing companies looking for speed to market

CHICAGO, July 11, 2022 – As life sciences employment grows in both major and emerging life sciences markets, advancements in innovation are accelerating across the United States. Yet real estate development occurs on a much slower timeline and finding space appropriately equipped for large-scale research, development and production is crucial to success. This year, the Cell & Gene Therapy (CGT) industry is set to have its highest annual number of regulatory approvals of new gene therapy and gene-modified cell therapy products, meaning a limited space supply could pose speed to market challenges.

“This seismic transformation in the underlying fundamentals of biomanufacturing real estate is having a direct impact on the availability of space, as well as its design, architecture, engineering and financing,” said Roger Humphrey, President, JLL Life Sciences.

Cell therapy generally involves removing, modifying, then reintroducing modified live cells into a patient, whereas gene therapy involves altering or replacing faulty genes within a patient’s cells, in both cases with the common goal of specifically targeting and treating/curing a certain disease. Unlike small molecule drugs which are derived by chemical synthesis and have historically been the dominant way of making pharmaceutical drugs, CGT produces “living drugs,” leveraging the human body’s own biological processes to fight or even cure disease. While CGT is creating enormous positive health implications for patients, as a field it also fundamentally changes the talent, regulatory, and infrastructure framework necessary to bring drugs to market, particularly when it comes to manufacturing.

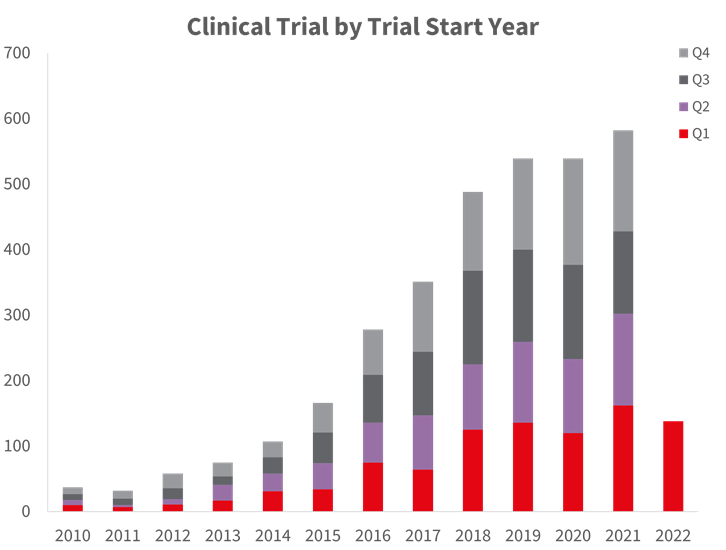

According to Global Data, 582 CGT clinical trials were initiated in 2021 as regulatory approvals of new gene therapy and gene-modified cell therapy products flourished. In Q1 2022, an additional 138 clinical trials were initiated. Therapy areas in Oncology, Infectious Diseases and the Central Nervous System account for 69 percent of all new clinical trials in the last three years.

“Decision making and the behavioral context of biomanufacturing is a lot more complex than the decision-making context of traditional lab R&D,” said Travis McCready, Head of Life Sciences, Industries Americas, JLL. “Companies’ biomanufacturing location decisions are driven by accessing a uniquely skilled workforce, as well as specialized real estate facilities. And since CGT biomanufacturing is now frequently occurring in parallel with R&D at the clinical-trial stage, more firms are seeking leasable biomanufacturing space within close proximity to their R&D operations, providing the top life sciences markets a further edge in fostering innovation.”

Pre-Clinical dosing and single product manufacturing facilities are increasingly positioning themselves close to R&D hubs to monitor and control process development, while accessing skilled labor. Clinical trials are typically concentrated in areas with a large population to drive trial participation. Markets with a strong healthcare industry and depth of medical research institutions are also top locations.

“There’s a perfect overlay for these different approaches to take place in the same regions and geographies—but in secondary suburbs or counties adjacent to the urban core,” McCready added. “Finding the right space near R&D hotspots like Boston, the San Francisco Bay Area, San Diego and others can be daunting, but not impossible using powerful location analytics that can help triangulate the proper infrastructure, talent, and capital.”

Investment in CGT has more than tripled over the past five years and shows no signs of slowing. According to a JLL analysis, total global regenerative medicine financing increased by 16 percent in 2021 to $23 billion dollars.

“Investor understanding and interest in developing and acquiring GMP facilities has been an education process and is gaining momentum as the biomanufacturing sector continues to accelerate,” said Lynn LaChapelle, Managing Director, JLL Capital Markets. “From an investment perspective, cGMP facilities have many base characteristics of industrial buildings, with inherent tenant ‘stickiness’ and lower second-generation tenant improvements as a majority of the occupiers fund their highly specialized improvements.”

– ends –

About JLL

JLL (NYSE: JLL) is a leading professional services firm that specializes in real estate and investment management. JLL shapes the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for our clients, our people and our communities. JLL is a Fortune 500 company with annual revenue of $19.4 billion, operations in over 80 countries and a global workforce of more than 100,000 as of March 31, 2022. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Contact: Kimberly Steele, JLL Sr. Manager, Public Relations

Phone: +1 713 852-3420

Email: Kimberly.Steele@am.jll.com

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE