Figures | U.S. Life Sciences | Q4 2021

CBRE RESEARCH | FEBRUARY 2022

⇑ 172.5 MSF Inventory

⇓ 4.8% Vacancy

⇑ $67.05 Avg. Asking Rent (NNN)

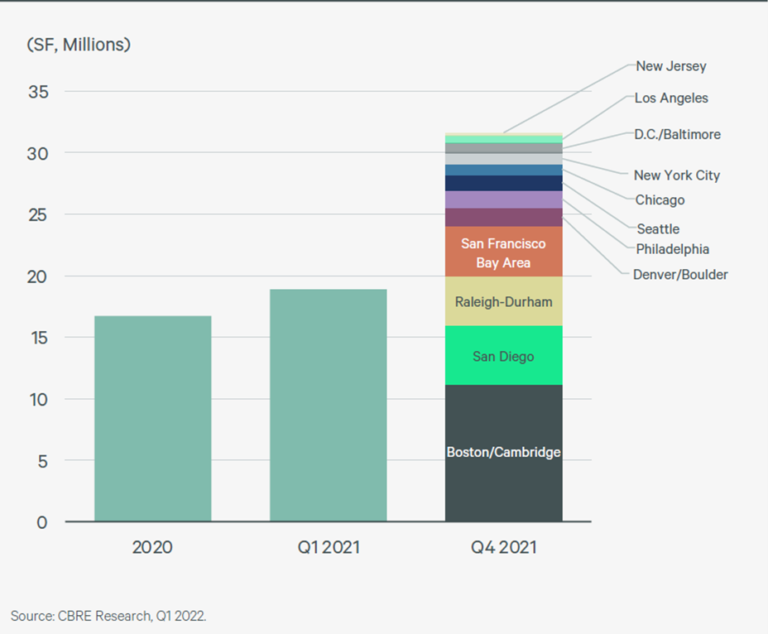

⇑ 31.6 MSF Under Construction

Note: Arrows indicate change from previous quarter.

• U.S. life sciences employment climbed in Q4 2021, with biotech R&D increasing 2.0% quarter over quarter. Year-over-year growth in biotech R&D employment grew 10.8%, compared to total non-farm employment’s 4.5%.

• U.S. life sciences employment climbed in Q4 2021, with biotech R&D increasing 2.0% quarter over quarter. Year-over-year growth in biotech R&D employment grew 10.8%, compared to total non-farm employment’s 4.5%.

• Venture capital funding in the life sciences sector hit a record-high $32.5B in 2021.

• Lab R&D vacancies remained low in most of the top 12 U.S. life sciences markets, with an overall decrease of 10 basis points in the vacancy rate quarter over quarter.

• With little available inventory, national average asking rents continued to push up, rising 7.8% during the quarter to $67.05.

• Lab R&D construction totaled 31.6 MSF of new developments and conversions across the top 12 markets, as developers sought to keep pace with growing demand. Speculative construction was on par with tenant demand; however, many under-construction projects may not deliver until 2023 or 2024, leaving fewer options for nearer-term requirements.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE