Revista panelists also discuss why some investors are paying such high prices for MOBs

By John B. Mugford

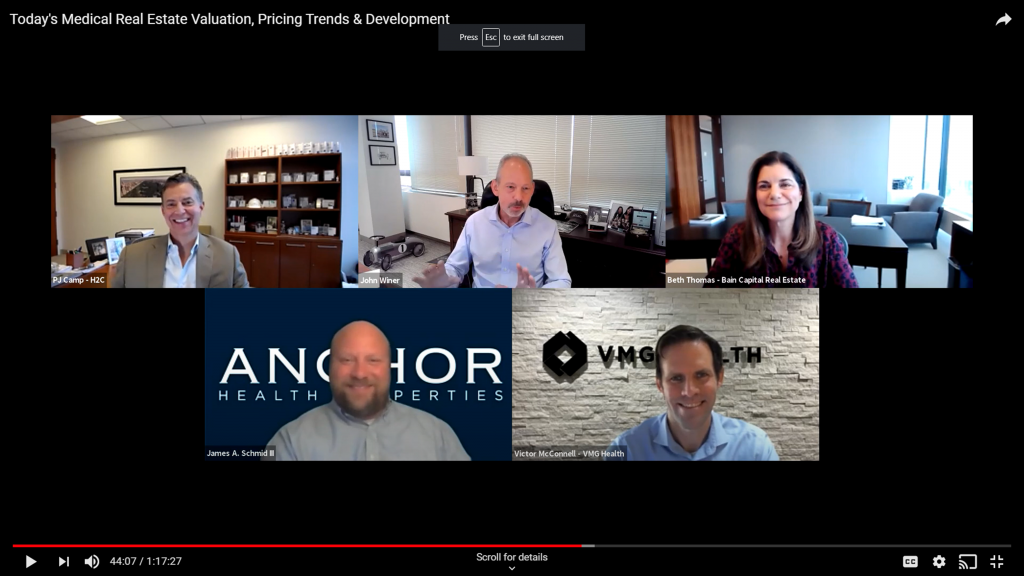

The Revista “Medical Real Estate Valuation” session included (clockwise from top left): PJ Camp of H2C, moderator John Winer of Seavest, Elizabeth Carrillo Thomas of Bain Capital, Victor McConnell, managing director of real estate services with Dallas-based VMG Health and James Schmid of Anchor Health Properties. (HREI photo)

By John B. Mugford

Although most healthcare real estate (HRE) professionals seem to agree that the fundamentals of the business haven’t changed much due to COVID-19, the pandemic seems to have accelerated at least one previous trend: Investors appear increasingly willing to buy in HRE product types other than only medical office buildings (MOBs).

“Healthcare real estate used to basically mean medical office buildings,” said Philip J. “PJ” Camp, managing director with New York-based Hammond Hanlon Camp (H2), a healthcare investment banking and advisory firm. “But along the way it got expanded to mean seniors housing and long-term care, and now, I think, and this is being increased as a result of COVID. It’s further expanded to include post-acute care, behavioral health, inpatient rehabilitation facilities (IRFs) and others.”

Why the broadened focus in a post-pandemic world? Simply put, there just aren’t enough MOBs to go around. A growing number of investors, including those with very deep pockets, have become interested in acquiring MOBs. That has created such strong demand for the product type that capitalization (cap) rates, or first-year estimated returns, are being compressed to historic lows.

“There’s been an awful lot of capital raised to invest in healthcare real estate,” Mr. Camp added, “and that capital has to go to work. And we’re seeing the demand for medical office buildings coming from a wide variety of investors, including a lot of private equity firms and the REITs (real estate investment trusts), which, by and large, have seen their stock prices recover” since the so-called COVID Crash of February to April 2020.

“So, while the core strategy of acquiring medical office buildings is certainly still very much in play, but with cap rates being compressed substantially, certain groups, longtime MOB investors, are

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE