Provider execs talk about their organization’s plans during recent Revista webcast

By John B. Mugford

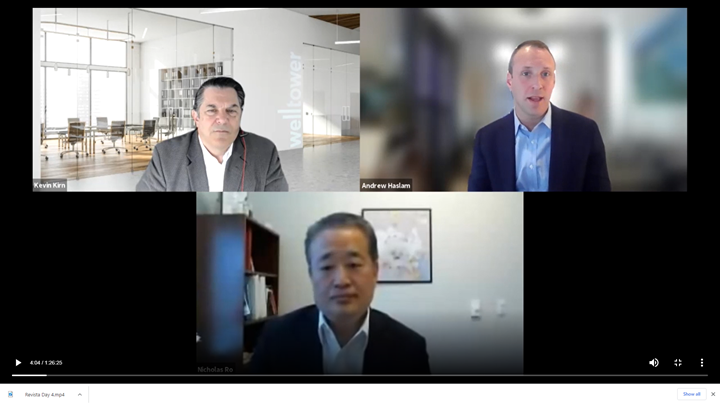

The April 21 Revista “Ambulatory Strategies” session included (clockwise from the upper left): Kevin Kirn of Welltower, Andrew Haslam of Providence Health & Services and Nicholas Ro of Kelsey Seybold Clinic. (HREI™ photo)

Despite initial fears that short-term pandemic-related losses would cause many healthcare providers to put capital improvements on hold, some say that can’t stand in the way of their long-term ambulatory expansion strategies – a mindset that could bode well for third-party developers and capital providers.

“COVID hit, but the underlying demographics continue,” noted Nicholas Ro, VP of Strategic and Legal Affairs for Pearland, Texas-based Kelsey Seybold Clinic, a 72-year-old physician group with 24 locations and more than 500 doctors throughout Greater Houston.

“But the way we provide acute-care services in the future that might look a little different,” added Andrew Haslam, VP of Real Estate Strategy with Renton, Wash.-based Providence Health & Services, which operates 54 hospitals and about 1,000 clinics in seven states on the West Coast.

The two healthcare executives weighed in on the subject during an April 21 panel discussion titled: “Ambulatory Strategies and Innovation in a Post-COVID Environment.” The session was part of a webcast sponsored by Arnold, Md.-based Revista, which compiles information concerning healthcare real estate (HRE) facilities for its subscribers.

Revista’s “Ambulatory Strategies” session was moderated by Kevin Kirn, VP of the Outpatient Medical Group at Welltower Inc. (NYSE: WELL), the nation’s largest healthcare real estate investment trust (REIT) in terms of market capitalization.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE