JLL

Medical Office

Perspectives

Healthcare Capital Markets

March 2021

2020 was a hot year for medical office and a notable shift in new entrants

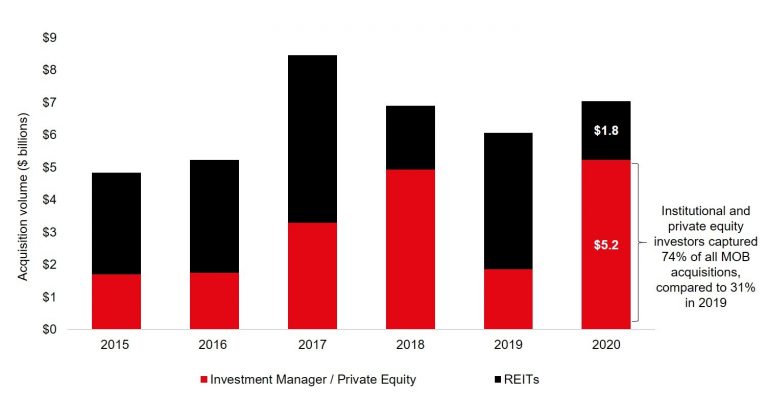

Medical office acquisitions by investor category ($B)*

*Investor acquisitions of medical office ≥ 25,000 s.f.

Source: JLL Research, SEC filings, Real Capital Analytics

Key points:

• Institutional and private equity investors dominated medical office acquisitions in 2020. These investors, seeking refuge in a durable asset class with reliable income, generated record historical volume, exceeding $5 billion. In addition, institutional and private equity investors set a record for their proportion of all MOB acquisitions, at 75 percent. Dedicated healthcare REITs, which historically have the greatest share of MOB purchases, were negatively affected in 2020 by lower share prices, similar to 2018 when a rise in interest rates clipped their wings after their record year in 2017. At $1.6 billion, dedicated healthcare REITs represented 24% of all acquisitions in 2020, consistent with 2018 activity, but substantially lower than their historical purchase share of 65 percent.

• The public to private valuation discrepancy prevailed in 2020, affecting the competitiveness of REITs in many property sectors, not just healthcare. Due to COVID-19-related operating challenges with respect to their seniors housing holdings, the Big Three diversified healthcare REITs were largely sidelined during the pandemic in 2020. However, REITs were not to be counted out altogether, as many diversified and MOB-only healthcare REITs acquired modest sums of medical office in excess of $200 million. Healthcare Realty led REIT activity in 2020 at nearly $550 million of acquisitions, some of which seeded the REIT’s new joint venture with TIAA-CREF. Given continued intense interest in medical office, MOB-only REITs are optimistic for 2021; many have publicly announced acquisition targets in the vicinity of $500 million.

• The most notable characteristic that emerged in 2020 was the accelerated growth in MOB market participants. In 2020, many new entrants and first-time buyers joined the household institutional names that have invested in medical office for three years or more. This activity has manifested itself in several ways. Recapitalization of portfolios with established operators such as Welltower and Remedy Medical has become a popular entry point for many investors new to the space, drafting off the expertise and operations of established players. Similarly, institutional investors have attracted abundant new capital via discretionary funds and separate accounts with pension and sovereign wealth funds as well as other foreign capital. Medical office has become a preferred property class amongst net lease investors based on its durable investment thesis, enhanced by a period of record low interest rates and MOB’s yield premium to other property types and fixed income investments; this has led to a rise in the activity of sponsors for syndicated equity via Delaware Statutory Trusts (DSTs) and other vehicles suited to retail investors. All of these investor categories have been well-supported by abundant and accretive financing given the solid loan performance of medical office properties both before and during COVID-19.

• While the appeal of medical office to real estate investors has grown due to its predictable performance and income qualities, investors are also competing against health systems for investment product at a level never seen before. JLL Research reported in December 2020 that health systems were on track to buy back a record $1 billion of healthcare properties in 2020 leased to them by third parties, known as “reverse monetization.” Many of the same benefits supporting investor activity, such as liberal access to capital and historically low interest rates, also accrue to health systems, in spite of the impact of COVID on operations. The financial impact from operations has accentuated the appeal of owning core properties, which generates cash savings by eliminating rent.

• Investor activity illustrates the swelling interest in medical office through the increase in new entrants and the outsized capital raise amongst established players, both motivated by exceptional 2020 returns. The new infusion of capital into the sector, the favorable lending environment and a constrained pool of properties available for purchase have created a competitive environment for acquisitions across all risk profiles. The near-term impact of competition is price increases and lower cap rates. However, outpatient medical care continues to grow, with the pandemic motivating providers to push more clinical activity out of the inpatient environment. Along with the growing and aging population translating into increased demand for healthcare services and points of care, medical office investors will be rewarded by steady growth in inventory of medical office over time.

Recent activity

New Listing – Investment Sale

Lifespan Oak Hill Medical Office Building

46,645 s.f.

Pawtucket, RI

Closed – Debt Placement

Jefferson Health Specialty Care Pavilion

452,000 s.f.

Philadelphia, PA

Closed – Debt Placement

3 Crescent Drive

95,261 s.f.

Philadelphia, PA

Closed – Investment Sale

Oakwood Medical Park

36,419 s.f.

Round Rock, TX

Closed – Investment Sale

Halo Chico Breast Care Center

14,170 s.f.

Chico, CA

Closed – Debt Placement

Memorial Hermann Surgery Center

12,935 s.f.

Richmond, TX

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE