The pandemic put an even brighter spotlight on the product type, Revista panel says

By John B. Mugford

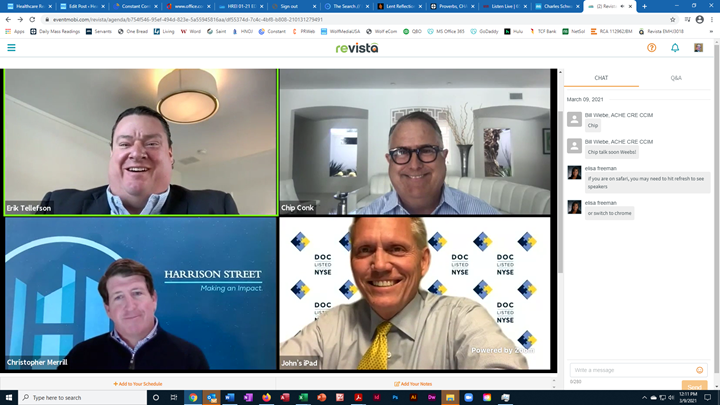

The Revista webcast panelists were (clockwise from the upper left): Erik Tellefson of Capital One Healthcare Finance, Chip Conk of Montecito Medical Real Estate, John Thomas of Physicians Realty Trust and Christopher Merrill of Harrison Street. (HREI photo)

For the past several years, professionals involved in the medical office building (MOB) sector have been saying that, aside from an economic downturn or total transformation of the healthcare system, there is just one thing that could slow the growth and success of the product type: a black swan event.

Well, from a business and economic perspective, the COVID-19 pandemic is the very definition of a black swan: an extremely rare, unanticipated event that caused widespread and catastrophic economic damage.

However, not only has the MOB product type survived seemingly unscathed, but it has thrived and even become a more desirable investment property type among an ever-growing pool of capital sources.

“As we’ve now seen going through a … few black swan events, I mean, these are resilient asset classes,” said Christopher Merrill, chairman and CEO of Chicago-based Harrison Street, a real estate investment firm he co-founded in 2005 and which has more than $32 billion of assets under management, with a strong focus on healthcare. “I think we’re all fortunate

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE