Seniors Housing Occupancy Rate Remains Steady Just Below 88% During Third Quarter

Eighth consecutive quarter of inventory growth above 3% annual pace

ANNAPOLIS, Md. – The occupancy rate for seniors housing across the United States was steady in the third quarter of 2018, according to new data from the National Investment Center for Seniors Housing & Care (NIC), a non-profit organization that provides data and analytics on the sector.

Occupancy in U.S. seniors housing properties averaged 87.9 percent in the third quarter of 2018, unchanged from the prior quarter and down 0.8 percentage point from a year ago. This places occupancy at its lowest level since the second quarter of 2011 (87.5%). Current occupancy is 2.3 percentage points below its most recent high of 90.2 percent in the fourth quarter of 2014.

“While the seniors housing occupancy rate has declined by 2.3 percentage points since year-end 2014, the number of occupied seniors housing units has actually increased during this same period by 8.9 percent, which equates to a solid 2.4 percent annual pace of increase,” said Chuck Harry, NIC’s chief of research & analytics. “It’s the fact that the rate of inventory growth has exceeded the absorption of units through this period that has driven the decline in the occupancy rate.”

The occupancy rates for independent living and assisted living properties averaged 90.2 percent and 85.3 percent, respectively, during the third quarter of 2018. The occupancy rate for independent living was unchanged from the prior quarter and down 0.4 percentage point from a year ago. The occupancy rate for assisted living was up 0.1 percentage point from the second quarter. The occupancy rate for assisted living was down 1.2 percentage points from a year ago.

Seniors housing annual absorption was 2.4 percent as of the third quarter of 2018, down 0.1 percentage point from the second quarter of 2018 and down 0.1 percentage point from one year earlier. The seniors housing annual inventory growth rate in the third quarter of 2018 was 3.4 percent, unchanged from the second quarter.

Preliminary data on construction as a share of existing inventory for seniors housing was 6.0 percent in the third quarter of 2018 and was 1.1 percentage points below its recent high of 7.1 percent in the fourth quarter of 2017.

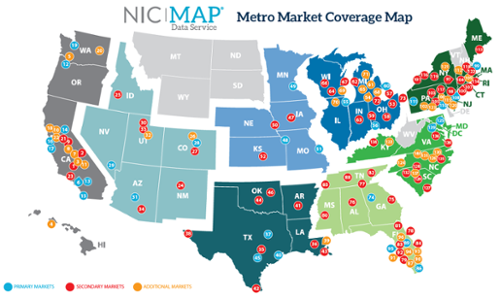

Seniors housing construction starts within the 31 Primary Markets during the third quarter of 2018 preliminarily totaled 2,349 units, which included 905 independent living units and 1,444 assisted living units. On a preliminary four-quarter basis, starts totaled 18,025 units. Construction starts data is often revised retrospectively in subsequent quarters as additional information becomes available.

During the third quarter of 2018, the average rate of seniors housing’s annual asking rent growth was 2.9 percent, up 0.2 percentage point from the prior quarter and down from a recent high of 3.8 percent in the fourth quarter of 2016. For comparison purposes, labor expense growth as measured by the annual change in assisted living average hourly earnings was 4.2 percent in the second quarter, according to the Bureau of Labor Statistics.

“Rent growth has been less than wage growth for the past six quarters,” said Beth Burnham Mace, chief economist for NIC. “With today’s tight labor markets, upward pressure on wages is likely to continue, which will put pressure on some operators’ ability to grow NOI.”

The nursing care occupancy rate decreased to 85.9 percent in the third quarter of 2018 from 86.2 percent in the second quarter of 2018. The nursing care annual inventory growth rate was -0.3 percent in the third quarter of 2018, while annual absorption was -0.7 percent. Private pay rents for the sector grew 2.4 percent year over year this quarter, down 0.2 percentage point from year-earlier levels.

About the National Investment Center for Senior Housing & Care

The National Investment Center for Seniors Housing & Care (NIC) is a 501(c)3 organization established in 1991 whose mission is to enable access and choice by providing data, analytics, and connections that bring together investors and providers. For more information, visit www.nic.org, and follow NIC on Twitter.

# # #

To learn more about the data and to speak with an expert, please contact Rachel Griffith at 202-868-4824 or RGriffith@MessagePartnersPR.com.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE