Healthcare Capital Markets Perspective – September 2018

JLL confirms that scale promotes institutional investment

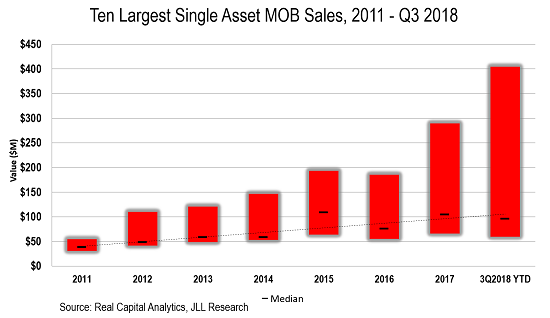

- The growing size of medical office buildings and the related need for healthcare providers to utilize third-party capital is increasing opportunities for institutional investment in the sector.

- For the first time, a medical building sold for more than $400 million – the 510,000 s.f. Memorial Hermann Medical Plaza in Houston sold for $405 million, or $800 p.s.f.

- Another sold for over $300 million – the 386,500 s.f. NYU Langone Ambulatory Care Center in Manhattan sold for $332.5 million, or $860 p.s.f.

- The scale and high price per square foot value of these buildings is supported by alignment with renowned market-leading health systems within urban core areas, reinforcing the investment thesis for institutional capital.

JLL believes the supply of large scale single-asset opportunities will continue as healthcare delivery becomes more concentrated with leading health systems in highly populated metros, accelerating investment activity in an increasingly accepted asset class.

Contact us:

Mindy Berman – 617 316 6539

Steve Leathers – 212 812 5867

Daniel Turley – 214 438 6374

Brian Bacharach – 214 438 6462

Justin Hill – 419 973 1854

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE