U.S. Medical Office Sales Reach $4.43 Billion at Mid-Year

Sept. 6, 2018 — (Chicago) — Investors in the U.S. continue to turn to medical office buildings in search of stability and strong returns — spending $4.43 billion during the first half of 2018, according to a Mid-Year Medical Office Report from Avison Young’s Chicago office. There were 417 properties, totaling 16.2 million square feet (msf), purchased through June of 2018.

Sept. 6, 2018 — (Chicago) — Investors in the U.S. continue to turn to medical office buildings in search of stability and strong returns — spending $4.43 billion during the first half of 2018, according to a Mid-Year Medical Office Report from Avison Young’s Chicago office. There were 417 properties, totaling 16.2 million square feet (msf), purchased through June of 2018.

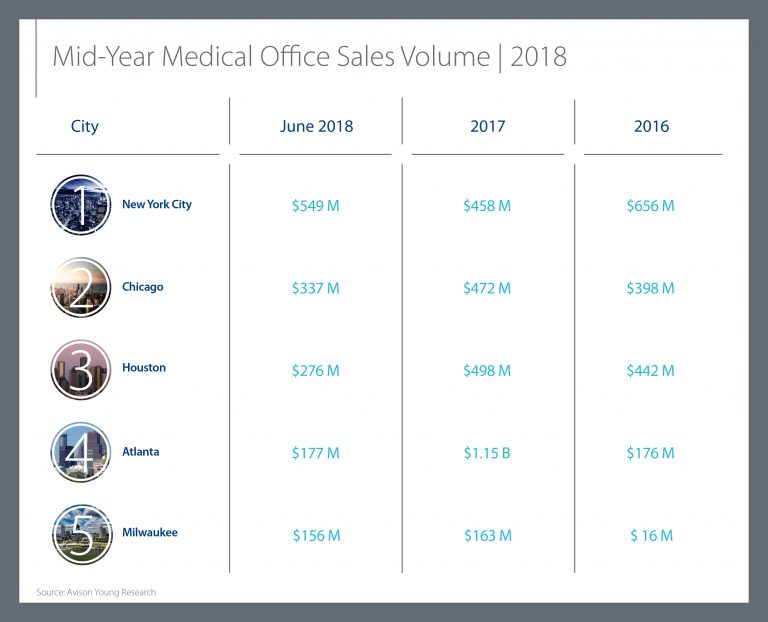

The most active markets were: New York City, $549 million; Chicago, $337 million, Houston, $276 million, Atlanta, $177 million, and Milwaukee, $156 million.

Demand for space remains strong and construction has been tempered. At the mid-point of 2018, supply of high quality assets is limited in many markets, due in part to the significant activity seen during the past several years.

In some instances, these assets were owned by physician groups that are looking to sell as a way to tap into the strong market. “We are seeing more and more physician groups, both large and small, looking to monetize their assets to manage long-term strategy and capitalize on market environment for leased assets,” comments Mike Wilson, an Avison Young Principal and a leader of the firm’s national healthcare capital markets group, based in Chicago. “Investors are focused on this sector as it provides a stable, lasting investment opportunity.”

As the healthcare industry has experienced consolidation and a push toward improving efficiency, medical office buildings have taken on more importance. Many tenants have long-term ties to their buildings and the communities they serve, creating a strong environment for investors.

According to Real Capital Analytics, pricing for medical office properties averaged $288 per square foot in the 12 month period from Q1 2017 to Q1 2018, a 13.8% increase from the previous 12-month period.

Over the past several years, REITS have made a bigger push into the medical office sector. Statistics show that during the past 24 months, three of the top four buyers—accounting for 226 property acquisitions totaling $5.64 billion— were REITS. Private equity firms, such as Harrison Street Real Estate Capital, which purchased 52 assets for a total of $1 billion in the past 24 months, have moved into the space in recent years, however.

Key Market Activity

- New York— In New York City, the volume for the first six months was approximately 20 percent higher than all of 2017, when $458 million was sold.

- Chicago— the $337 million volume for the first half of 2018 is on track to outpace the $472 million spent in all of 2017.

- Houston— $276 million was spent at mid-year 2018, following three strong years when totals included: $498M for 2017, $442M for 2016, and $404M for 2015.

- Atlanta— The $177M activity in this southern city was notable, as it is not on pace to match the $1.15 billion in sales for all of 2017.

- Milwaukee— the $156 million volume at mid-year is just shy of the $163 million spent in all of 2017 and both years represent a huge jump from the $16 million spent in 2016.

Among the notable sales were:

Chicago — DuPage Medical Group Portfolio — A 439,000-SF, eight building portfolio, was purchased by Harrison Street Real Estate Capital for $240 million in June 2018. The buildings are in Naperville, Lisle, and other west and southwest Chicago suburbs.

Chicago — JOHA Cancer Center Portfolio — a four-building, 170,511-SF portfolio in Chicago’s suburban market was sold to Community Healthcare Trust for $33 M in April 2018. Avison Young’s national healthcare capital markets group represented the ownership, a private physician’s group.

Milwaukee, WI— a 124,562-SF building at 2801 Kinnickinnic River Pkwy sold for $54M as part of a larger portfolio.

Foreign Investment

In the first half of 2018, Germany emerged as the top foreign buyer of medical office properties, spending $341 million. Hong Kong ranked number two with $116 million, followed by the UK, with $75 million. China, which was the top foreign buyer in 2017, with $278 million in investments, was not on the list for 2018.

To download the complete report, please click here.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE