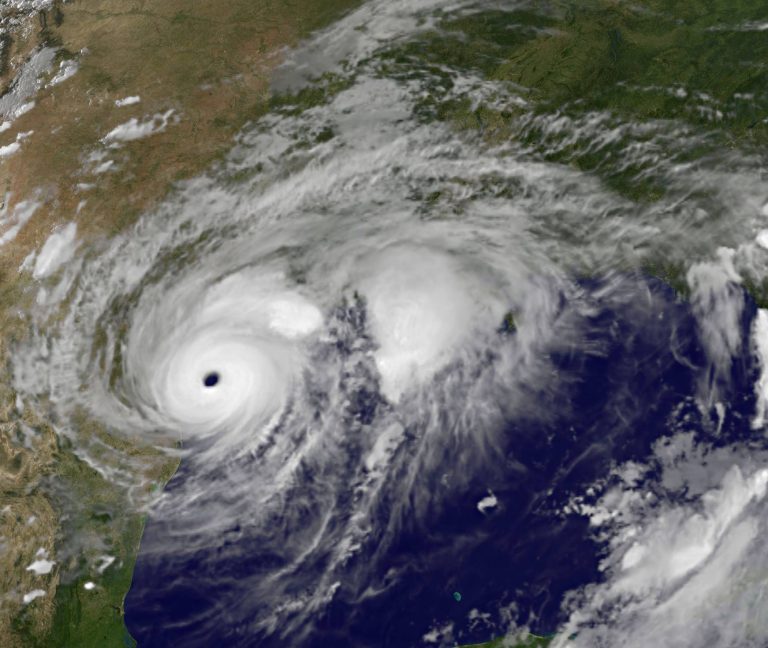

MedProperties’ recent $230 million acquisition of the Harrison Street Portfolio was unusually large and complex, involving three sellers, 18 properties in 10 states, intense time pressure, and unconventional financing. Now throw in two hurricanes, a cyber-attack, two new babies, a failed phone system, a trip to the emergency room, and a few more surprises, and it’s little wonder that the participants refer to the epic deal as the Perfect Storm.

By Murray W. Wolf

As anyone who follows the healthcare real estate (HRE) business undoubtedly knows by now, MedProperties Holdings closed on a major transaction Sept. 5: the acquisition of the first 15 properties of the so-called Harrison Street Portfolio, which included 17 assets in 10 states totaling 620,750 square feet at a cost of about $230 million. And in its news release announcing the transaction, MedProperties noted that several of the properties had been threatened by Hurricanes Harvey and Irma but emerged unscathed.

But what didn’t come out in the news release, the participants say, is that the stormy path to a successful closing required the team overcome a lot more than hurricanes. In an exclusive interview with Healthcare Real Estate Insights™, three of the key players in the transaction provided an inside look at the transaction they came to call the “Perfect Storm.”

A tale of three sellers

When three of the key players in the Harrison Street acquisition – Darryl Freling, Steve Hewett and Chris Bodnar – sat down to discuss the deal with HREI™ just nine days after the closing, they seemed simultaneously elated, amazed and a bit weary. Gathering in an otherwise vacant meeting room at the Westin Galleria Dallas during a break from the Sept. 14 InterFace HRE Conference, they were delighted to have closed the deal, amazed at what it took to get it done and perhaps still a bit fatigued from the grueling six-month process, which they dubbed the “Perfect Storm,” and which Mr. Freling also code named “Project Greyhound.” (Why Project Greyhound? More on that later.)

Mr. Freling is a managing principal with MedProperties Holdings LLC, the buyer; Mr. Hewett is a senior VP with The Sanders Trust, one of the three sellers; and Mr. Bodnar, an executive VP with CBRE who co-leads the firm’s Healthcare Capital Markets Group, was the broker.

Steve Hewett of The Sanders Trust, Darryl Freling of MedProperties and Chris Bodnar of CBRE sat down with Healthcare Real Estate Insights™ in Dallas recently for an exclusive interview to discuss the Harrison Street MOB Portfolio acquisition. (HREI™ photo)

Harrison Street Real Estate Capital LLC is a real estate investment management firm that invests exclusively in the education, healthcare and storage sectors. During the past several years, Mr. Bodnar explains, Chicago-based Harrison Street had aggregated a portfolio of “great facilities,” some of which were owned in separate partnerships with “two first-class operators and developers of healthcare real estate,” The Sanders Trust, based in Birmingham, Ala., and Pisula Development, based in the Houston suburb of The Woodlands, Texas.

The story of what became the largest acquisition in MedProperties’ 10-year history began when Mr. Bodnar and the CBRE team was working with Harrison Street on the potential asset sale in early 2017. It “took a lot of time to determine the right makeup for the portfolio,” he recalled.

“There was some pulling out of some different properties to make sure that we had the right mix and age of assets, lease term remaining, credit on the deal, and went through some direct-owned assets with Harrison Street as well.”

Ultimately, CBRE and the sellers settled on a 10-state, 18-property portfolio that was put on the market in March 2017. (One property was eventually dropped from the transaction for reasons explained below, making the eventual total portfolio size 17 assets.)

“I was on the flight out to L.A. (to attend the InterFace HRE West Conference) and on my iPad and I got your teaser on this deal,” Mr. Freling recalled, looking at Mr. Bodnar. “And I looked at the portfolio before even knowing who had put it together, and I said, ‘This looks like a portfolio that we would have either invested in the development of or aggregated ourselves.’

“But I loved all of these assets and I pulled Chris aside when I got to L.A. and I said, ‘We’re going to buy this portfolio.’ Little did we know the challenges that were going to get involved, but that was the start of it.

“So we put our bid in – first round bid,” Mr. Freling continued. “(We) had some hiccups between our first round bid and our second round bid. But ultimately we were able to pull together the capital stack from some conventional and unconventional sources to get it under contract… It was challenging. There was no point in the transaction that it wasn’t challenging.”

The first challenge was

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE