The time is ripe if senior housing is any indication, new JLL report contends

BOSTON – It appears to be only a matter of time before a foreign investor makes a headline-grabbing acquisition of a large U.S. medical office building (MOB) portfolio, according to a new report from the Boston-based Healthcare Capital Markets team with Chicago-based Jones Lang LaSalle Inc. (NYSE: JLL).

BOSTON – It appears to be only a matter of time before a foreign investor makes a headline-grabbing acquisition of a large U.S. medical office building (MOB) portfolio, according to a new report from the Boston-based Healthcare Capital Markets team with Chicago-based Jones Lang LaSalle Inc. (NYSE: JLL).

In its June 2017 Healthcare Capital Markets Perspective newsletter, JLL contends that the rapid rise of foreign investment in another type of U.S. healthcare real estate (HRE), senior housing properties, suggests that the MOB sector might be next. Foreign investment in U.S. senior housing has totaled $3.4 billion during the past decade, JLL says, with most of that coming in the past five years.

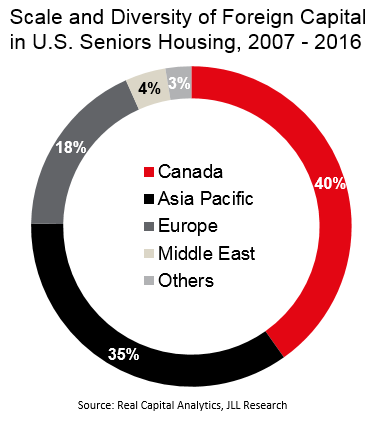

Canadian capital has led the foreign investment pack in the past decade, representing 40 percent of $3.4 billion total. Coming in a close second is the Asia-Pacific region, which accounted for 35 percent of total foreign senior housing investment since 2007.

One of the largest foreign investments in senior housing in recent years was announced in November 2016, when a joint venture (JV) partnership of two Chinese firms, Cindat Capital Management Ltd. and Union Life Insurance Co. Ltd., said it would acquire a 75 percent interest in a portfolio of properties owned by Toledo, Ohio-based Welltower Inc. (NYSE: HCN).

At the time the deal was announced, Greg Peng, CEO at Cindat Capital Management, said: “With aging demographics and U.S. healthcare trends driving the need for innovative healthcare infrastructure, we believe the sector represents an attractive long-term investment opportunity.” He added that the JV has a “significant appetite for investing in the sector and we look forward to a mutually beneficial relationship with Welltower to capitalize on this unique opportunity.”

In addition to looking to capitalize on the growing U.S. healthcare sector, the JLL team notes that foreign investors are showing more and more interest in MOBs in order to diversify their investments while also seeking “yield plus a hedge against political and currency risk. It’s early innings, but it’s a hot topic with investors from Europe, Asia-Pacific, Middle East and the Americas for this formerly ‘alternative’ asset class.”

In summing up its prediction about a large foreign acquisition in the MOB space, the newsletter states: “JLL believes the time is ripe for a major medical office acquisition by a foreign investor given prior investment activity in large-scale U.S. seniors housing.”

The JLL team includes: Mindy Berman, managing director, and executive VPs Daniel Turley, Steve Leathers and Brian Bacharach.

For a copy of the JLL report, please visit:

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE