Investment Highlights

Investment Highlights

- 59,587 SF Multi-Tenant MOB (95% Leased)

- 0.3 Miles from 329-Bed Floyd Memorial Hospital (BBB- Credit)

- Floyd Memorial Leases 60% of the Space & Would Like to Expand

- Sub 7-Percent Market Vacancy Within a 5-Mile Radius

Offering Summary

| Price | $11,350,000 |

| Down Payment | (35%) $3,972,500 |

| Loan Amount | $7,377,500 |

| Loan Type | Proposed New |

| Interest Rate/Amortization | 4.750% / 30 Years |

| Rentable SF | 59,587 |

| Price Per Rentable SF | $190.48 |

| Year Built | 1996 |

| Parcel Size | 7.28 AC |

| Cap Rate – Current | 7.00% |

| Net Cash Flow After Debt Service – Current | 8.38% |

| Total Return – Current | 10.98% |

Investment Overview

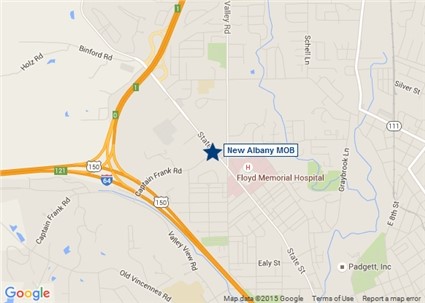

Marcus & Millichap is pleased to present the New Albany MOB. The project is located in the Louisville, KY MSA at 2125 State Street in New Albany, IN.

The New Albany MOB is a 59,587 SF, multi-tenant medical office building situated near the Floyd Memorial Hospital campus. Located 0.3 miles from the 329-bed Floyd Memorial Hospital (BBB- Credit), the subject property is a testament to the growing demand for medical services in the local area. Floyd Memorial occupies 60% of the current rentable space and would like to further expand their operations at the property. Floyd Memorial Hospital is currently under contract to be acquired by the A- credit rated Baptist Health. The project is currently 95% leased to 3 tenants offering an investor the opportunity to own a stabilized and majority credit leased MOB.

The building’s excellent access to the I-265, coupled with its close proximity to the Floyd Memorial Hospital, provides ideal positioning and convenient services.

Operating Data

Income |

Current |

| Base Rent | |

| Occupied Space | $841,008 |

| Available Space at Market Rents | $46,886 |

| Gross Potential Rent | $887,894 |

| Expense Reimbursements | $241,117 |

| Other Income | $2,160 |

| Gross Potential Income | $1,131,171 |

| Vacancy/Collection Allowance | 5.3% / $46,886 |

| Effective Gross Income | $1,084,285 |

| Total Expenses | $289,671 |

| Net Operating Income | $794,614 |

| Debt Service | $461,814 |

| Debt Coverage Ratio | 1.72 |

| Net Cash Flow After Debt Service | 8.38% / $332,799 |

| Principal Reduction | $103,309 |

| Total Return | 10.98% / $436,108 |

| Expenses | |

| Real Estate Taxes (1) | $128,200 |

| Insurance | $10,500 |

| Utilities | $55,000 |

| Repairs & Maintenance | $39,000 |

| Management Fee (2) | $43,371 |

| HVAC | $3,700 |

| Janitorial | $4,400 |

| Other | $3,300 |

| Security | $2,200 |

| Total Expenses | $289,671 |

| Expenses Per SF | $4.86 |

Contact Information

Nicholas Reese

Associate

Tel: (949) 419-3200

Fax: (949) 419-3210

Nicholas.Reese@marcusmillichap.com

www.marcusmillichap.com/NicholasReese

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE