Pending $4B acquisition of G-A REIT II is one of the largest HRE deals in years

By Dan Larson

Currently, medical office buildings (MOBs) comprise about 0.2 percent of the healthcare portfolio owned by New York-based NorthStar Realty Finance Corp. (NYSE: NRF).

By the end of this year, however, that number should multiply significantly, to about 28.6 percent. On Aug. 5, the company announced that it had agreed to make one of the blockbuster healthcare real estate (HRE) deals of 2014: the purchase of Irving, Calif.-based Griffin-American Healthcare REIT II (G-A REIT II), which spent the last five years compiling a $2.9 billion portfolio of diversified HRE assets.

The deal calls for NorthStar to acquire all of the REIT’s shares in a stock and cash transaction valued at $4 billion, including $600 million of debt. The boards of directors of both firms have unanimously approved the definitive merger agreement, and the deal is expected to close in the fourth quarter (Q4) of 2014. Of course, the target of Northstar’s purchase is the portfolio accumulated by G-A REIT II, which includes about 11.5 million square feet in 145 MOBs, 91 senior housing properties, 45 skilled nursing facilities and 14 hospitals scattered across 31 states and the United Kingdom.

According to The Wall Street Journal, NorthStar had been interested in acquiring G-A REIT II and its portfolio months prior to the August announcement, but it decided to drop out of the running when negotiations elevated the price to a reported $4.26 billion.

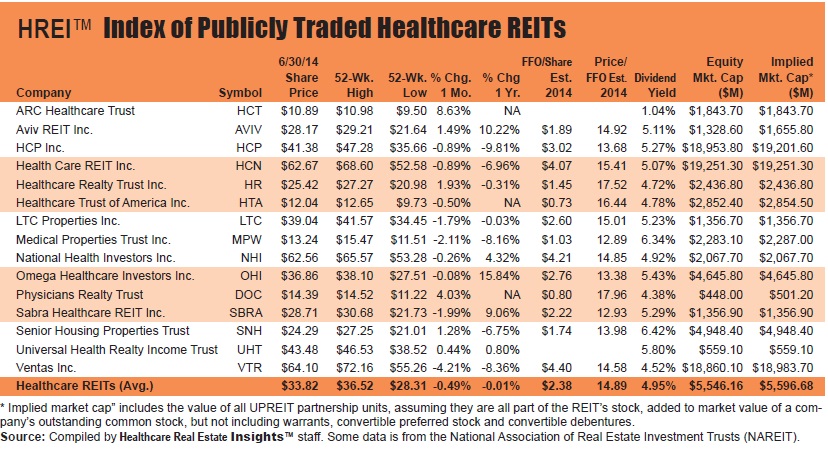

At the time, several news reports indicated that New York-based ARC Healthcare Trust Inc. (Nasdaq: HCT), led by well-known deal-maker Nicholas Schorsch, was in exclusive negotiations to acquire G-A REIT II.

But then, in a bit of shocking news, Chicago-based Ventas, Inc. (NYSE: VTR), the country’s largest healthcare REIT, announced that it would acquire ARC for about $2.6 billion. Now, it seems fair to say that ARC had helped drive up the price of G-A REIT II, causing NorthStar Chairman and CEO David Hamamoto, at one point, to declare that his company was not interested.

“That was true at the time, given what we were led to believe the pricing was going to be,” Mr. Hamamoto said during a conference call with analysts in early August. “As things evolved and the process changed, the factors lined up in our favor.”

The pending deal represents a major leap into the MOB arena for NorthStar Realty, which has become quite active in HRE – mostly on the seniors housing side – since James F. “Jay” Flaherty, the former CEO of HCP Inc. (NYSE: HCP), joined the firm in January 2014.

Disclaimer: The author has no financial position in any of the companies mentioned and this article does not constitute an investment recommendation.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE