Healthcare Capital Markets Perspective

August 2018

The growth in outpatient care and investors’ desire to capture the benefits of this stable, yet high growth, sector propelled high first half 2018 transaction volume.

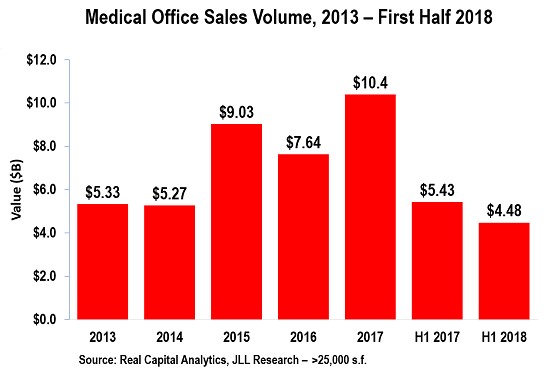

The growth in outpatient care and investors’ desire to capture the benefits of this stable, yet high growth, sector propelled high first half 2018 transaction volume.- MOB sales in the first half of $4.5 billion continued at near record pace and in line with total annual volume prior to recent peak years as investment interest in MOB continues at a feverish pace.

- Adjusted for the record $2.2 billion HTA acquisition of the Duke Realty healthcare portfolio in June 2017, first half volume in 2018 was in fact higher than any other prior year.

- Four large portfolio sales made up 25% of total first half numbers, demonstrating the sector’s ingenuity in sustaining momentum with highly-sought after scale offerings; portfolio sales over $100 million include the PHT MOB portfolio sold by a public pension fund, Aurora Health Care’s buy back of its properties sold in a leaseback arrangement in the early 2000s, the DuPage Medical Group sale-leaseback in Illinois and Invesque’s acquisition of the Mohawk Medical REIT holdings.

- With many more large investor portfolios in various stages of closing and notable large single asset closings like the record-breaking $405 million Memorial Hermann Medical Plaza acquired by a LaSalle fund, 2018 promises to be another breathtaking year for MOB sales.

- Continued capital raise by dedicated healthcare investors combined with new private and institutional capital are a strong endorsement for medical office and points to the investment market’s desire for quality and durable income in a more fully-priced environment.

JLL Healthcare Capital Markets

JLL Healthcare Capital Markets is the only national full service healthcare capital markets team in the real estate industry focused on medical office, hospitals, seniors housing and post-acute care. The team consistently transacts over $1 billion annually with unrivaled expertise and experience in investment sales, monetization, development debt and equity capital raise and advisory services for investor and provider clients. JLL has an extensive national and international presence that delivers local market knowledge and exceptional access to capital.

Mindy Berman

Managing Director

+1 617 316 6539

Steve Leathers

Managing Director

+1 212 812 5867

Daniel Turley

Managing Director

+1 214 438 6374

Brian Bacharach

Managing Director

+1 214 438 6462

Justin Hill

EVP, Healthcare

+1 419 973 1854

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE