Growing optimism, lower interest rates and the biggest MOB deal ever

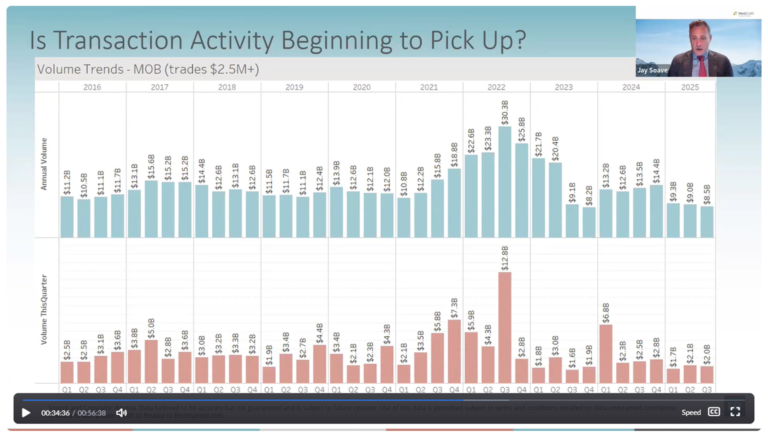

Although MOB sales for the first three quarters of 2025 were the lowest in a decade, higher occupancy rates and rents were a silver lining for owners, Revista said. (Slide courtesy of Revista)

NATIONAL – If there was a major change in the healthcare real estate (HRE) and medical outpatient building (MOB) sector that took place in 2025, it was that optimism, at least from a growing number of professionals involved in space, was on the rise in the second half of the year.

“I think what you’re really seeing in the market now is pent-up desire to buy, pent-up desire to sell, all of which is being led by interest rates that are expected to come down and, in reality, are coming down,” said Ted Barr, principal with Cleveland-based Woodside Health, which focuses on acquiring MOBs, during the 16th annual InterFace Healthcare Real Estate Conference in Dallas in October.

“And, tied to that, lenders are back in the market, and they are wanting to lend and the spreads are coming in.”

Steve Leathers, senior managing director of Healthcare Capital Markets with Houston-based Transwestern, moderated the panel session in which Mr. Barr made his comments. The session was titled, “The Investment Market is Back! What to Look for in Q4 and 2026.” Mr. Leathers said that while “investment sales have been down when you look at historic standards … as a panel, we’re pretty optimistic (moving forward).”

At an HRE conference a couple of weeks later, the InterFace Healthcare Real Estate Southeast conference in mid-November in Nashville, Tenn., a group of panelists talked about coining a possible tagline for the coming year of 2026. They had noted that, as the market slowed in recent years, a familiar slogan that emerged last year was, “Survive ‘til ‘25.”

During the InterFace panel titled, “The State of the Healthcare Real Estate Market Heading Into 2026,” Ryan Crowley, executive VP and chief investment officer with Nashville-based Healthcare Realty Trust Inc. (NYSE: HR), said to the session moderator, “You asked about taglines for ‘26. My thought is that as the lenders continue to be aggressive and there’s more money out there, both on the equity side and on the debt side, and so, if you were a buyer on the sidelines, come on in. If you were a seller on the sidelines, come on in.

“So, the new tagline should be: ‘Get back in the mix in ‘26.’”

On that positive note, let’s take a look at HREI’s annual highly subjective list of the top 10 HRE news stories of the past 12 months.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE