In a webcast, CBRE and BlackBirch say they foresee a stronger second half

By John B. Mugford

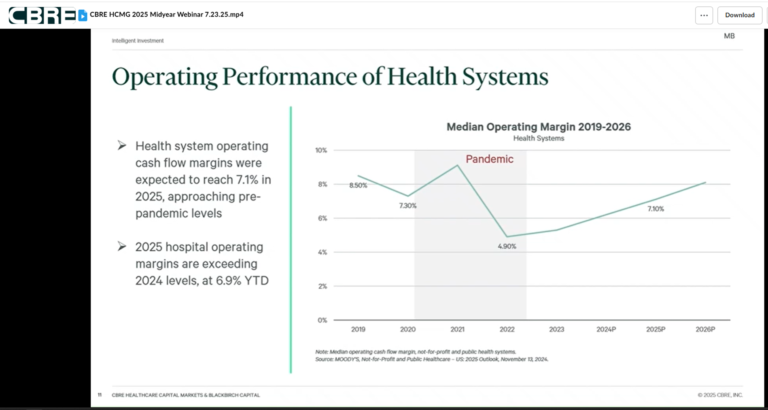

Health systems, many of which struggled during the pandemic, are now doing better financially and are generally optimistic about the future. However, they see a continued need to tighten their belts with some possible challenges on the horizon. (Slide courtesy of CBRE)

Here are some of the takeaways from the recent webcast, “2025 Capital Markets Mid-Year Recap,” which was conducted by the U.S. Healthcare Capital Markets team with CBRE Group Inc. (NYSE: CBRE) and New York-based BlackBirch Capital:

■ Medical outpatient building (MOB) sales are quite certain to continue to bounce back in 2025 from a slowdown during the past two years, with an increasing number of portfolio transactions being an impetus for the higher volume.

■ A major reason why the MOB sales volume is likely to increase over the second half of 2025 and into next year is that the debt markets have opened up quite a bit compared to the past two years. More lenders are looking to make deals in a healthcare real estate (HRE) sector where they see ongoing strong fundamentals.

■ Health systems, many of which struggled during the COVID-19 pandemic, are now doing better financially and are, for the most part, optimistic about the future. However, they see a continued need to tighten their belts with some possible challenges on the horizon, such as a potential loss of a substantial number of Medicaid recipients.

■ Many more outpatient facilities will be needed in the coming years to keep up with demand for healthcare services, especially due to demand driven by an aging population.

■ Equity capital sources are eager to invest in the HRE sector, especially those seeking core assets.

The webinar, which was hosted by Chris Bodnar, vice chairman of CBRE’s U.S. Healthcare Capital Markets team, aired in late July. It included presentations by several CBRE and BlackBirch professionals as well as two guest presenters: Gary Lieberman and David Oberdorf, both of whom are managing directors in the Investment Research Group with McLean, Va.-based Capital One Financial Corp. (NYSE: COF).

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE