By eporter on August 1, 2024

Meanwhile, construction completions totaling 5 million sq. ft. push vacancy rate to 16.7%

Dallas – Aug. 1, 2024 – The U.S. life sciences real estate market generated positive net absorption in the second quarter while a wave of construction completions nonetheless increased the national lab vacancy rate, according to a new report from CBRE.

Net absorption is a measure of how much existing lab space is newly occupied in a quarter against how much space is newly vacated. Net absorption in the U.S. lab market was positive through 2021 and 2022 before turning negative in mid-2023 as the economy cooled. It has vacillated between gains and losses since.

Despite positive net absorption last quarter, an abundance of new supply continued to weigh on the market. Completion of 5 million sq. ft. of labs in the second quarter – with only 7% of that square footage leased before completion – pushed the national vacancy rate to 16.7%. That’s up 2 percentage points from the previous quarter, and up 7.5 percentage points from the same period a year earlier.

“The story of the U.S. life sciences real estate market in mid-2024 is one of encouraging underlying performance balanced against the completion of lab construction started months or years ago,” said Matt Gardner, CBRE Americas Life Sciences Leader. “The construction pipeline is tapering. That will give the market time to absorb the excess supply.”

The 21 million sq. ft. of lab space under construction at the end of the second quarter marked a 47% decline from a year earlier. It is the lowest amount of in-progress lab construction since the second quarter of 2021.

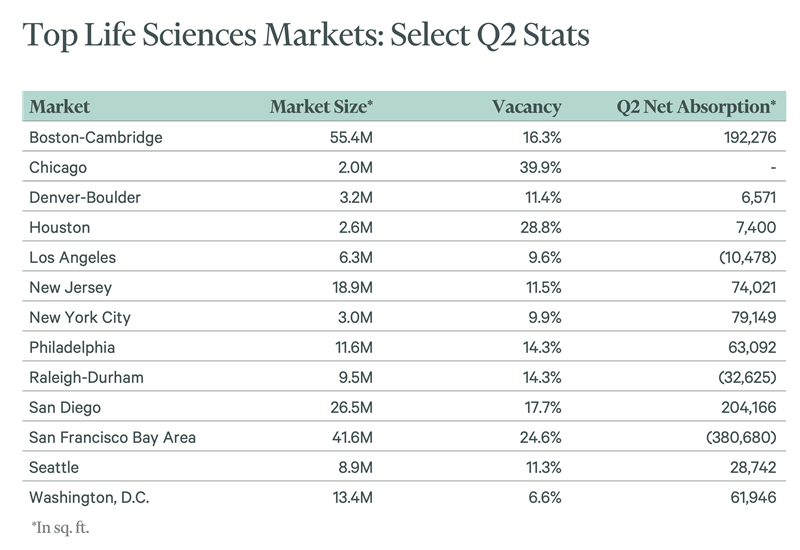

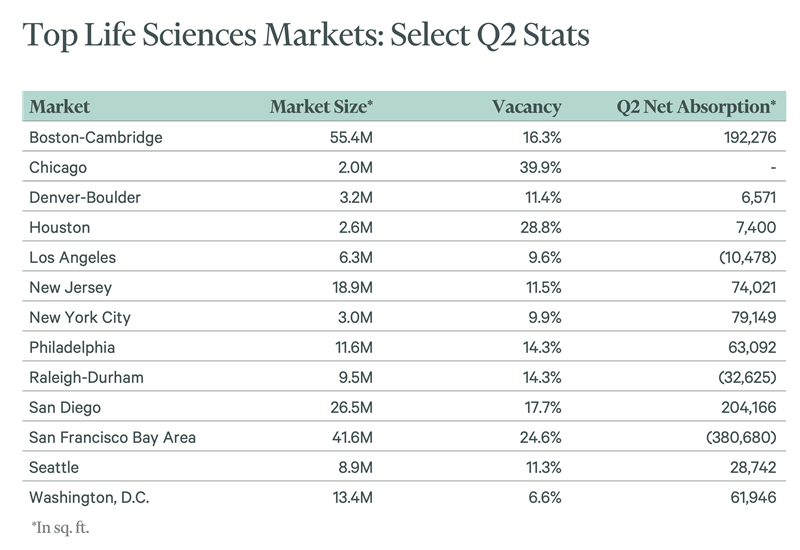

CBRE’s national life sciences figures are averages of the largest 13 U.S. life sciences markets. Ten of those 13 markets registered positive net absorption in the second quarter, led by San Diego and Boston. The three with negative net absorption were San Francisco, Raleigh-Durham and Los Angeles.

Also in the second quarter, average asking rents were $71.84 per sq. ft., up 2.7% from the previous quarter. Venture capital funding for U.S. life sciences companies reached its highest level since the second quarter of 2022 at $5.2 billion.

To read the full report, click here.

|

|

|

|

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2023 revenue). The company has more than 130,000 employees (including Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.

|

|

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE

Posted in Breaking News, Companies & People, Life Sciences