Dallas – June 5, 2024 – CBRE’s annual

U.S. Life Sciences Talent Trends report newly analyzes life sciences employment by subsector, mapping out the top markets and employment trends across the research & development, manufacturing and medical technology fields.

CBRE also expanded its third-annual analysis to 100 U.S. markets from 74 in last year’s report, thus including up-and-coming markets such as Madison, Wis., and Trenton, N.J.

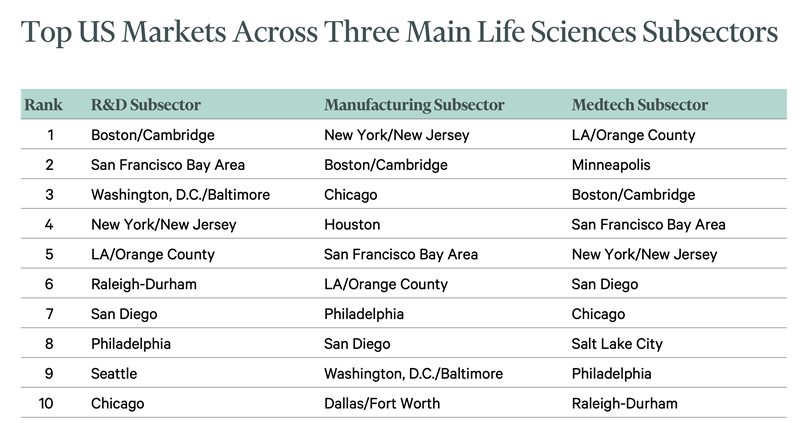

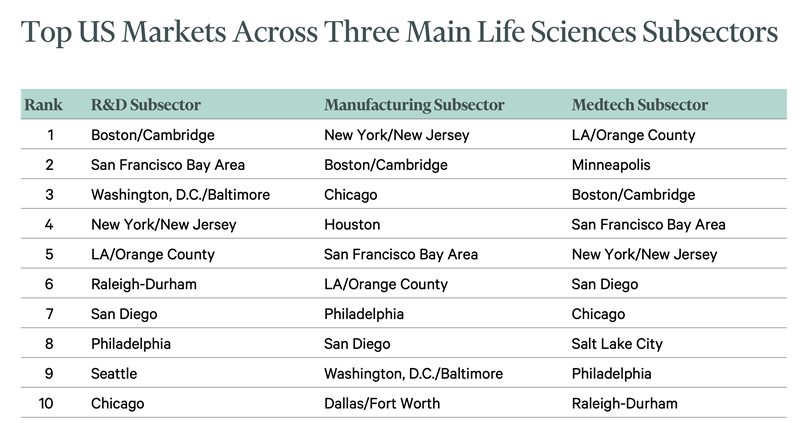

Seven markets ranked within the top 10 of all three subsectors: Boston/Cambridge, the San Francisco Bay Area, New York/New Jersey, LA/Orange County, San Diego, Philadelphia and Chicago. Of those, Boston/Cambridge notched the highest average ranking across the three subsectors.

Overall, U.S. life sciences job growth has been sluggish since interest rates began rising in 2022. The industry’s job growth – specifically in biotechnology R&D and pharmaceutical/medicine manufacturing – amounted to 0.2% since June 2022 after gaining 15.8% in the same period prior to June 2022.

Even so, demand for life sciences talent is strong. Unemployment in the sector is below 2%, compared to roughly 4% for all professions. That’s despite an increase in U.S. biological and biomedical science graduates over the past decade, up 54% from the 2010-2011 academic year to 173,825 in 2021-2022.

“The overall theme for the U.S. life sciences industry last year and this year is resiliency,” said Matt Gardner, CBRE Americas Life Sciences Leader. “We expect life sciences employment to hold steady over the next year and to perhaps decline in a few markets. But this talent is valuable – life sciences specialists who leave one job often find another quickly.”

CBRE evaluated the largest 100 U.S. life sciences labor markets against multiple criteria for each of the three specialties. For the R&D subsector, that included the number and concentration of life sciences researchers; number of new graduates, and specifically with doctorate degrees in that field; concentration of all doctorate degree holders; and concentration of jobs in the broader professional, scientific, and technical services professions.

For the manufacturing and medtech sectors, the analysis covered the number and concentration of key professions in the markets.

Research & Development

Boston, the San Francisco Bay Area, and San Diego are the traditional stalwarts in R&D. Washington, D.C., and the New York/New Jersey area also rank highly.

Boston tallies the most bioengineers and biomedical engineers, biochemists, biophysicists, microbiologists, medical scientists and biological technicians of any U.S. market. Meanwhile, New York/New Jersey generates more life sciences graduates than any market.

Manufacturing

The life sciences manufacturing subsector, which includes drug manufacturing as well as cell and gene therapy, has New York/New Jersey, Houston and Philadelphia among its largest markets. Life sciences manufacturing favors markets with large, established bases of manufacturing and distribution labor, such as Houston with its chemical and oil & gas sectors.

Medtech

The medtech subsector, which includes designing and producing medical devices, is led by Los Angeles/Orange County with nearly 57,000 medtech specialists and Minneapolis/St. Paul with more than 38,000. Together, they account for 37% of the medtech labor pool among the 100 markets in CBRE’s analysis. Leading medtech markets tend to be anchored by big companies.

To read the full report, click here.