Panelists discuss their use, and appeal to investors, during BOMA MOB conference

By John B. Mugford

Interest in has picked up since the onset of the COVID-19 pandemic, Kirat Kharode of HealCo Medical Office Timesharing told BOMA MOB conference viewers. (HREI photo)

As health systems and other providers continue to explore ways to expand their reach into new communities or markets, they are undoubtedly looking for as many ways to do so as efficiently as possible.

If their research indicates that they should have a strong presence in a certain market, they will sometimes build and own a new medical office building (MOB). Other times, they might lease space in a new or existing MOB that was developed and is owned by a third-party.

However, more and more providers are also considering medical timeshares – allowing them to dip their toes in the water of new markets, avoiding large capital commitments while retaining flexibility with their occupancy.

“As a real estate investor, part of a real estate investment company, you have to think, generally, that this is a lot of where healthcare is moving,” said Blake Bratcher, who as an executive VP with Charlotte, N.C.-based Flagship Healthcare Properties leads the firm’s ambulatory surgery center (ASC) strategy and portfolio.

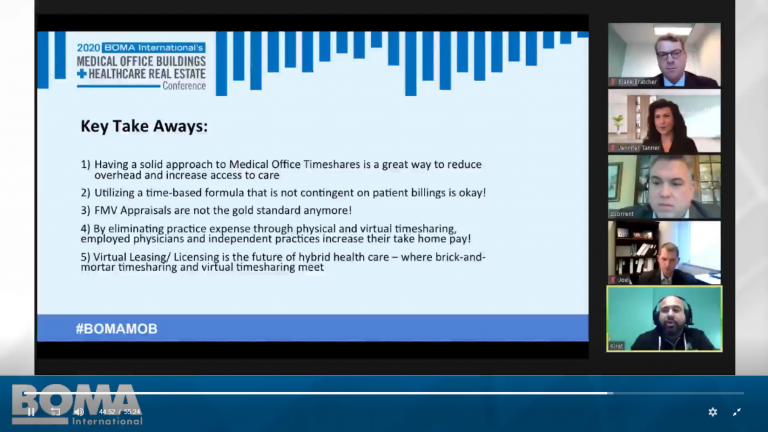

Mr. Bratcher was part of a panel session discussing the use of medical office timeshares during the BOMA International Medical Office Buildings & Healthcare Real Estate Conference held on Nov. 4-5. Like most conferences taking place since the onset of the pandemic, the 2020 BOMA MOB conference was an online event.

The session was titled “Medical Office Timeshares of the Future: A Health System Without Walls.”

The moderator was Kirat Kharode, CEO and founder of Jersey City, N.J.-based HealCo Medical Office Timesharing. The other panelists were Jennifer Tanner, real estate manager with Chicago-based CommonSpirit Health; David Sorrentino, complex care medical director with Minnetonka, Minn.-based United Healthcare (NYSE: UNH); and Joseph Wolfe, an attorney with Hall Render.

“I don’t think you can ignore that they’re here to stay and they’re going to grow,” Mr. Bratcher continued. “There’s a low cost of capital, which allows providers to go and provide care where patients need it… And, it allows providers who have space and time to … offset their cost in a meaningful way as their margins get thinner and thinner. I’ve really seen those synergies work.”

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE