Private equity investors recently discussed which healthcare business have the most positive outlook.

By Murray W. Wolf

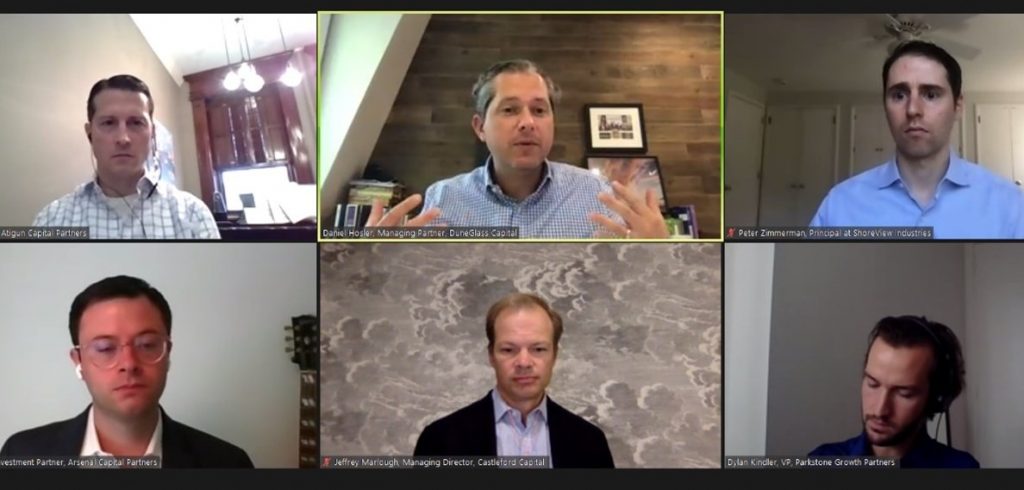

The iGlobal Forum webcast on “The Future of Healthcare Amdist COVID-19” featured six private equity investors. (HREI photo)

A group of private equity firm executives who gathered for a recent webcast are investors in healthcare operating companies, not healthcare real estate (HRE). But their thoughts on which healthcare businesses are attractive investments provides some insights into which real estate property types might be in high demand in the future – and which ones won’t.

The session, titled, “Independent Sponsor & Capital Provider Sector Spotlight: The Future of Healthcare Amidst COVID-19,” was presented by iGlobal Forum, a New York-based events company. The webcast included six executives from private equity firms that invest in healthcare operating companies (opcos).

Asked which areas of healthcare have a positive outlook amid COVID-19, Peter Zimmerman, a principal with ShoreView Industries, a Minneapolis-based private equity firm, said that telehealth “was an obvious one.” But he added that the outlook was also promising for “provider-based businesses with positive reimbursement tailwinds and pretty steady demand, like primary care.”

“We do really like primary care,” agreed John DiGiovanni, an investment partner with New York-based Arsenal Capital Partners. “We are very bullish on the shift to value-based care,” he continued, which places more emphasis on outcomes than patient volumes.

“I like to find businesses where telehealth delivery could be truly transformational,” added Daniel Hosler, a managing partner with Chicago-based DuneGlass Capital. “I think about telepsychology or telepsychiatry…”

“We do view telehealth as a really interesting opportunity,” Mr. DiGiovanni agreed, although the costs are “a bit irrational” to invest in telehealth firms right now.

David Sturek a New York-based partner with Atigun Capital Partners, said the pandemic hasn’t necessary changed which healthcare businesses have the most potential, but it has created a disruption and accelerated certain segments that had been developing more slowly. He said there has been an “explosion” in telehealth and other tech-enabled services during the pandemic.

Mr. Sturek added that his firm’s behavioral health-related businesses “have seen a substantial increase in demand” due to COVID. “After initially stabilizing those businesses and implementing safety protocols, he said, “We’ve jumped on the opportunity and more aggressively pursued some expansion plans.”

“If you’re in a sector that is resilient or benefitting from COVID, it’s a great time to double down,” agreed Mr. DiGiovanni of Arsenal Capital Partners. His firm has invested in Hopebridge, an opco that provides outpatient autism care for children. Since the onset of the pandemic, he said, parents have made it clear that the autism services provided are essential, not discretionary. That has helped to validate his firm’s plans to grow the platform, he said.

As for those healthcare businesses that will be most negatively impacted by COVID, Mr. Zimmerman said, “Anything with exposure to state Medicaid is at least going to be a question for the near future. If state tax revenues decline significantly, that’s one area where they look to cut. So I would be wary of businesses with too much exposure there.”

Another class of healthcare businesses facing challenges, said Jeff Marlough, a managing director with New York-based Castleford Capital, “is any type of business where there is an elective procedure versus a needed procedure. People are holding off on those, and that has impacted businesses there.”

“On the negative side, I could not be more bearish on hospitals,” Mr. Hosler declared. “We’re still seeing a lot of interest in certain types of elective procedures…. But the procedures that were historically done in hospitals are now moving to ASCs (ambulatory surgery centers). And those that were historically done in ASCs are moving into in-office settings. And those that were done in-office are now moving into the home. And if you try to get in the way of that trend, I just think you’re going to get run over.

“And I’m nervous about hospitals. I actually think we have a coming crisis” because the more profitable procedures – such orthopedics, OB/GYN and certain urology with oncology treatments – “these are all moving out of the hospitals, in some cases even skipping the ASC… It’s going to put some real downward pressure on the overall acute care hospital.”

The moderator, Dylan Kindler, a New York-based VP with Parkstone Growth Partners, said this can all be summarized in two key points. First, there has been an acceleration of the ongoing shift toward tech-enabled healthcare. Second, we are in a time of “recession investing,” meaning that businesses dependent on state budgets or discretionary spending are in “tough spots.” Conversely, Parkstone, which has an investment in BayView Dental Associates, a Florida-based dental practice, has seen during COVID that dental care is non-discretionary – not only recession-resistant, he said, but also “pandemic-proof.”

With regard to the volume of healthcare company private equity transactions taking place, the complaint of the opco private equity investors had a familiar ring to what we hear from HRE investors: There’s a huge amount of capital chasing relatively few opportunities, creating an imbalance of supply and demand.

As for the future of the healthcare business, Mr. Hosler of DuneGlass Capital, which invests in medical practices in the Midwest, concluded, “We are challenging ourselves not to return to pre-COVID times. Why do we have a waiting room? I want to reimagine every aspect of our business… So I think it’s a real opportunity, especially with technology, to reimagine what’s possible in the delivery of care.”

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE