JLL Healthcare Capital Markets

Medical Office Perspectives

August 2020

MOB sales retained momentum in the first half of 2020, breaking out distinctly from the overall office sector

MOB sales retained momentum in the first half of 2020, breaking out distinctly from the overall office sector

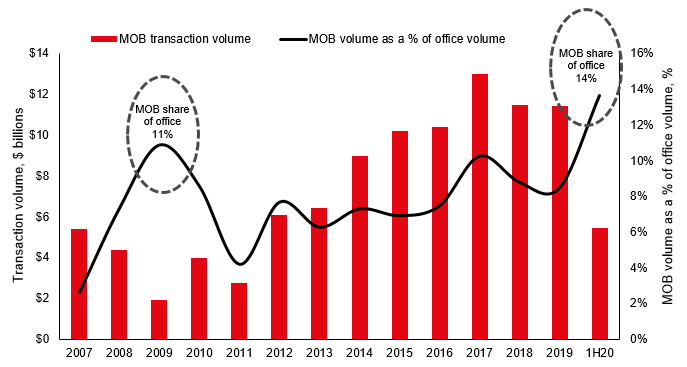

Medical office sales volume and share of total office sales

Key points:

· Medical office sales retained their momentum of the past several years during the first half of 2020, totaling $5.5 billion; this represents a 10 percent increase from the first half of 2019, a noteworthy accomplishment in the midst of the global pandemic.

· Additionally, first half medical office sales came in at nearly half of the total medical office volume for 2019 – another good omen for the anticipated year-end 2020 total, given that sales volume typically accelerates in the second half of the year. This suggests that 2020 total sales are on track to exceed their 2019 total, despite the uncertainty associated with the pandemic.

· Enthusiasm for medical office investment in the first half of 2020 stands in contrast to overall office sales, which declined 38 percent year-over-year during this time. Remarkably, at 14 percent, the share of all office sales represented by medical office in the first half of 2020 doubled its historical average rate of 7 percent. This outsized share is explained by the fact that the durability and dependability of the medical office sector and its cash flows are more frequently sought out during weaker economic periods; medical office enjoyed an 11 percent share in 2009, during the depths of the financial crisis.

· The stable performance of medical office has solidified this defensive asset class in investors’ view and attracted new investment capital even in the face of remarkable economic strain.

Have you seen the JLL 2020 Healthcare Real Estate Outlook? Click on the link to access this year’s report.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE