JLL Healthcare Capital Markets

Medical Office Perspectives

February 2020

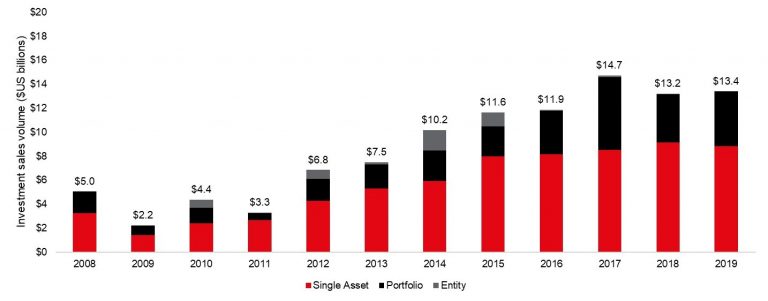

JLL research reports medical office sales totaled $13.4 billion in 2019, near all-time highs of 2017 and 2018

Total Medical Office Investment Sales

Source: JLL Research, Real Capital Analytics (transactions larger than $2.5 million)

Key points:

· Medical office sales volume in 2019 was a bright spot; offering investors continued opportunities to invest in stable income-producing properties with strong and long-dated tenancy. 2019 was the sixth consecutive year of MOB sales greater than $10 billion – the new normal for this asset class – reinforcing the desirability of medical office.

· Year-over-year sales from 2018 to 2019 were remarkably consistent at more than $13 billion. While this is lower than the total of $14.7 billion in 2017, that year included the $2.8 billion blockbuster Duke Realty healthcare division spinout. Large portfolios also contributed heavily to the 2019 total, with approximately one-third of volume generated from notable trades, including the $1.3 billion CNL healthcare portfolio and $786 million Hammes Partners MOB portfolio, both advised by JLL.

· Overall allocation by real estate investors to medical office continued at a high level in 2019 with new private equity fund raising creating more than $5 billion of dry powder available for healthcare property acquisitions. Healthcare REIT share values have also reached peak valuation levels, and combined with the dry equity powder referenced above, has resulted in higher allocation targets for acquisitions by many investors. The positive financing environment for healthcare properties continues to attract lenders to the space, many of whom are new entrants to the MOB space, due to the longer duration of leases, many of which are credit. The supportive financing terms for loan advances, interest only or 30 year amortization schedules and historically low interest rates, has underpinned strong property valuations and superior investor returns, relative to other asset classes.

· Medical office remains a favored sector for real estate investment at this point in the cycle, as evidenced by new entrants into the space (institutional investors, private equity funds and HNW individuals). This compelling investment thesis for medical office has significantly driven the supply of investment capital (debt and equity) waiting to be deployed into this space, providing a very liquid and competitive market for sellers. The demand-driven increase in healthcare services from a growing and aging population (10,000 people per day turning 65) has pushed hospitals and health systems to create lower cost outpatient care alternatives. Medical tenants will find ready capital waiting to meet these needs.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE