Healthcare Capital Markets Perspective

November 2017

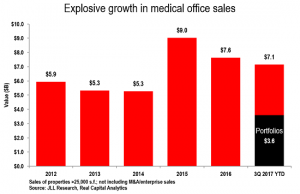

- Sales of medical office buildings through Q3 2017 are on pace to break the all-time record in 2015.

- Aiding the momentum were notable portfolio sales that contributed to more than half the volume. Four portfolios totaled $3.6B: Duke Realty healthcare, the MB Real Estate recapitalization and the Dignity Health and Harrison Street portfolios.

- Current MOB sales volume can be viewed as the “tip of the iceberg.” With a total MOB market value of $363B, less than 2% of MOBs are trading annually. If MOB sales came into line with typical standards of 8-9% annual turnover in traditional sectors, MOB transaction volume would quadruple and the institutional ownership of the sector would deepen.

- With more announced portfolios yet to close, 2017 promises to be another breakout year.

JLL Healthcare Capital Markets

JLL Healthcare Capital Markets is the only national full service healthcare capital markets team in the real estate industry focused on medical office, hospitals, seniors housing and post-acute care. The team consistently transacts over $1 billion annually with unrivaled expertise and experience in investment sales, monetization, development debt and equity capital raise and advisory services for investor and provider clients. JLL has an extensive national and international presence that delivers local market knowledge and exceptional access to capital.

Mindy Berman

Managing Director

+1 617 316 6539

Daniel Turley

Executive Vice President

+1 214 438 6374

Steve Leathers

Executive Vice President

+1 212 812 5867

Brian Bacharach

Executive Vice President

+1 214 438 6462

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE