Healthcare Capital Markets Perspective

June 2017

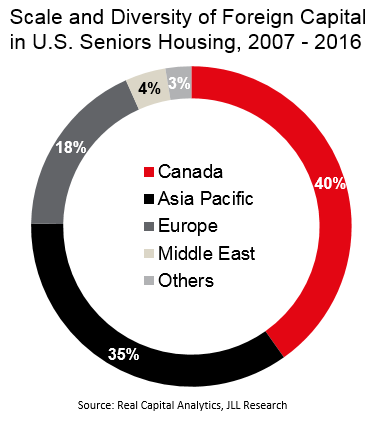

- U.S. seniors housing has been a magnet for global capital with $3.4 billion in investments in the last 10 years, most in the last five years. Canada leads the pack with 40% of the total investment activity, followed closely by Asia-Pacific at 35%.

- Chinese capital alone accounted for $2.6 billion in 2016 in North American healthcare properties including the $930 million investment by Cindat and Union Life for a 75% stake in a portfolio of Brookdale seniors housing and Genesis Healthcare post-acute care facilities owned by Welltower.

- Interest in U.S. medical office from global investors is on the rise as they seek diversification and yield plus a hedge against political and currency risk. It’s early innings, but it’s a hot topic with investors from Europe, Asia-Pacific, Middle East and the Americas for this formerly “alternative” asset class.

- JLL believes the time is ripe for a major medical office acquisition by a foreign investor given prior investment activity in large-scale U.S. seniors housing.

Contact us

Mindy Berman

Managing Director

+1 617 316 6539

mindy.berman@am.jll.com

Daniel Turley

Executive Vice President

+1 617 316 6521

daniel.turley@am.jll.com

Steve Leathers

Executive Vice President

+1 212 812 5867

steve.leathers@am.jll.com

Brian Bacharach

Executive Vice President

+1 214 438 6462

brian.bacharach@am.jll.com

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE