Generational Differences Driving Growth, Advancement in Today’s Medical Office Market

Generational cohorts create diverging trends in healthcare. The aging U.S. population, combined with emerging differences in the way generations process healthcare information, have been signifi cant drivers in the nation’s healthcare industry. As the 65-and-older age segment increases by 20 million individuals over the next 10 years, demand for healthcare services will rise. While the baby boomer generation has a huge impact on the current growth of the healthcare industry, the millennial generation, which has surpassed the baby boomers in size, is driving a major shift in the care delivery model and the way they approach, research and resolve issues.

• Technological advances as well as the ability to search online for doctors, research treatment options and use web-based diagnostic and health tracking tools are placing a wealth of knowledge and information about personal healthcare into the hands of the patient.

• Millennial and future generations will further drive an emerging trend in the revitalization of healthcare, preferring quick access to physicians and more transparency from providers and insurance companies regarding coverage and costs.

• Urgent/acute care centers, retail clinics (walk-in centers often located in pharmacies and grocery stores) and stand-alone emergency departments are replacing primary care physicians and hospital emergency rooms as this generation strives for more efficient and affordable healthcare options.

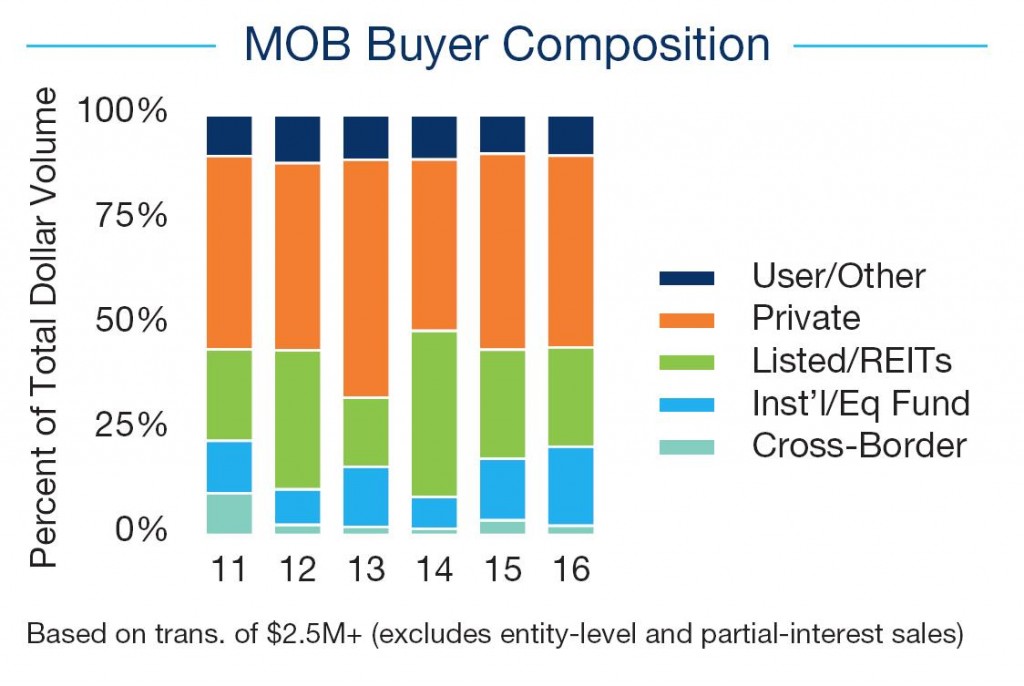

Strong demographic trends support growing industry, remain driver in investment activity this year. Institutional funds and REITs are actively searching for larger deals and portfolios. Private capital is emerging as a major option in the $5 million to $20 million price tranche and could begin to take a larger share of transactions this year. A rise in crossover capital is also increasing competition for medical offi ce properties as single-tenant retail investors target similar investment opportunities in this segment for higher yields. For-sale inventory is limited as medical office assets are in high demand with cap rates compressing over the past several years.

• On-campus medical offi ce buildings command premium cap rates, trading at sub-6 percent initial yields for single-tenant properties, while multi-tenant buildings draw first-year returns in the mid-6 to low-7 percent range.

• Off-campus medical offi ce properties with strong tenancy, which often include a healthcare system and long remaining lease terms, are in high demand. These properties fetch initial returns in the mid-6 percent area.

• Yields on other off-campus medical assets, including those in need of repositioning or located in secondary or tertiary markets, can trade up to 200 basis points higher. Factors such as quality, location, deferred maintenance and tenancy have an impact on returns for these assets.

To download the complete Marcus & Millichap “2017 Outlook” report, please click here. (Registration required.)

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE