Despite Record Occupancy, Areas of Uncertainty Remain for Health Care

Overall, 2016 was a year of expansion for health care real estate in the United States. The national vacancy rate for medical office buildings (MOB) hit an all-time low. Net absorption of MOB space was the highest since 2008 while average rents grew. Investment activity—while down slightly from 2015—remained strong and compressed capitalization rates slightly.

Overall, 2016 was a year of expansion for health care real estate in the United States. The national vacancy rate for medical office buildings (MOB) hit an all-time low. Net absorption of MOB space was the highest since 2008 while average rents grew. Investment activity—while down slightly from 2015—remained strong and compressed capitalization rates slightly.Yet as 2017 gets underway, health care providers and health system owners are facing a variety of considerations that could impact their businesses and real estate strategies. While every change in administration ushers in some level of uncertainty, the industry is facing many questions surrounding the repeal of the Affordable Care Act (ACA) and the details of coverage to replace it. As a result, decision-making in this dynamic sector is likely to be delayed for a time, especially if these policy changes evolve over a protracted and contentious process.

Health care providers are also grappling with the implementation of the final terms for the site-neutral payment rule—which limits the way off-campus facilities are reimbursed by Medicare. This will likely challenge the financial viability of future off-campus real estate projects and cause health care providers to reevaluate relocation or expansion opportunities.

The health care industry is also facing a continued wave of rising costs—from services to construction materials to labor. The U.S. population is aging, which heightens the demand for health care.

Health care expenditures per capita exceeded $10,000 in 2016 and are forecast to grow at an average annual rate of 5.8% through 2025. However, providers are increasingly receiving less insurance income and are under constant pressure to protect operating margins while still innovating, improving and enhancing services.

In the face of these challenges, health care real estate fundamentals remain solid and the industry will likely remain buoyed by consumer demand. It will continue to be as important as ever for providers to base real estate decisions in a nuanced understanding of the consumer landscape, the real estate environment and investment opportunities.

Key Takeaways

> Vacancy: Strong demand for MOBs pushed the national vacancy rate to an all-time low of 7.4% at year-end 2016.

> Absorption: MOB net absorption increased by 25% in 2016 from 18.1 million square feet to 22.7 million square feet—the highest annual total since 2008.

> Rents: Full service gross (FSG) MOB rents rose by 8% in 2016 to a national average of $24 per square foot.

> Construction: Following 14.6 million square feet of deliveries in 2015, the 2016 delivery total is set to exceed 22 million square feet—just below the 2008 peak of 24.9 million square feet. Nonetheless, this new supply is still modest in inventory terms, representing only 1.7% of the total MOB universe.

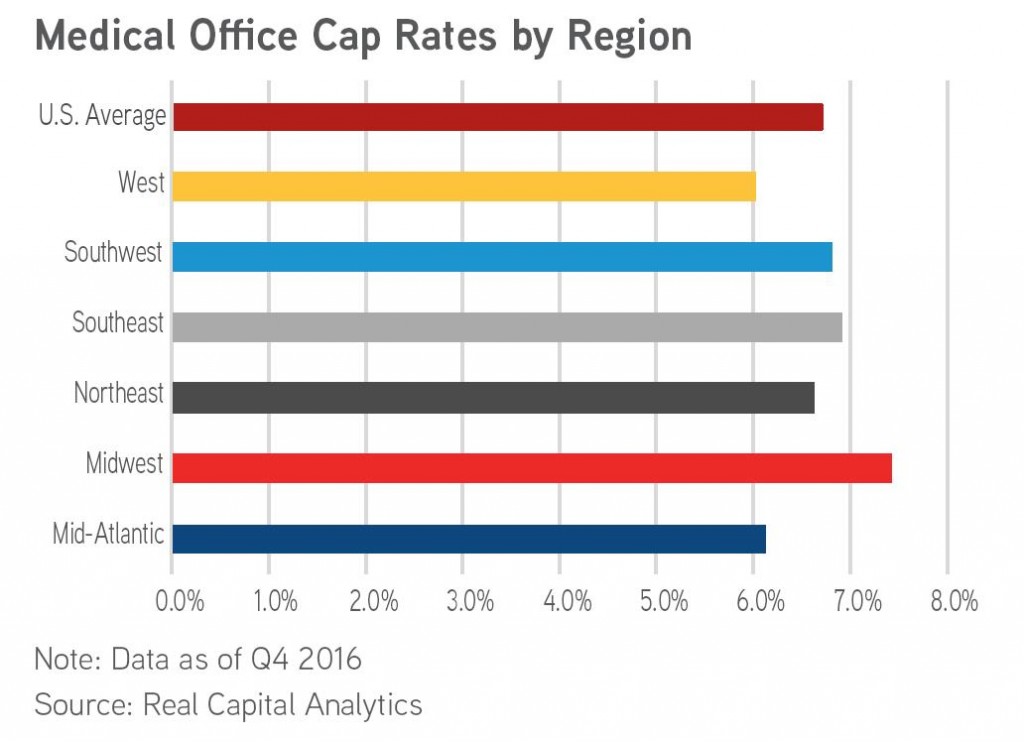

> Sales: Total investment in MOBs fell from $11.6 billion in 2015 to a still-respectable $9.3 billion in 2016. At 6.7%, average MOB cap rates are in line with the office sector average cap rate of 6.5%.

To download a complete copy of the Colliers International Releases 2017 Health Care Marketplace Report, please click here.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE