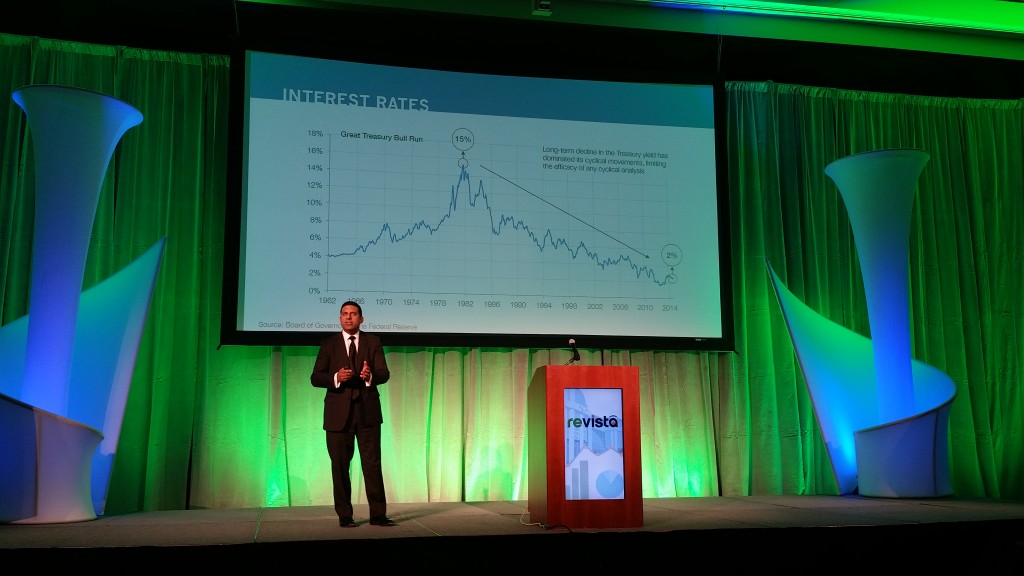

During the Revista Executive Forum in Chicago, economist Sam Chandan said that by avoiding its past mistakes – and not making new ones – the commercial and healthcare real estate sectors might be able to avoid the another downturn. Photo by HREI™

Real estate is notoriously cyclical, but this time might be different. Really.

By Murray W. Wolf

The past two years were good ones for commercial real estate (CRE) in general and healthcare real estate (HRE) in particular, even as the broader U.S. economy struggled to recover from the Great Recession. Now, paradoxically, as the economy as a whole continues to strengthen, the favorable conditions that spurred the real estate markets might be headed in the other direction.

But this time we might be able to avoid the all-too-familiar boom-and-bust CRE cycle. Yes, this time it might be different. Seriously.

Why did CRE and HRE boom in 2013-14?

“The stars have been fairly well aligned over the last couple of years” for CRE and HRE, economist Sam Chandan, Ph.D., declared during the recent Revista Executive Forum in Chicago. But “they haven’t been well aligned for the economy… We know that things haven’t gone as well as they could have. The recovery has been a difficult one. We’ve struggled to pull ourselves out of the Great Recession, even though the Great Recession has been over for far longer than it lasted.

“Well, circumstances are beginning to change over the last couple of years in this very difficult environment,” said Dr. Chandan, founder and chief economist of Chandan Economics and a professor in the Real Estate Department at the Wharton School of the University of Pennsylvania.

CRE thrived during the past two years because the underlying weakness in the economy allowed for a very favorable set of circumstances in the capital markets, he explained. The “significant monetary policy interventions” of the Federal Reserve System have resulted in a historically low cost of capital, with risk-free U.S. Treasury bonds yielding zero or even negative inflation-adjusted returns. That has prompted many investors to shift their capital to other sectors, just as the Fed intended.

The CRE sector has been one of the beneficiaries, Dr. Chandan noted, as high-quality commercial real estate has some of the same attractive characteristics as fixed-income investments while offering relatively higher returns on an ongoing basis. In addition to a very low cost of capital, limited new development has contributed to stronger real estate fundamentals and driven up asset values.

Even so, some of the underlying conditions that drove positive outcomes in the CRE sector in 2013-14 are poised to change in 2015-16, Dr. Chandan cautioned. There’s a growing sentiment that economic growth will be stronger, with an improving labor market. If the economy strengthens significantly, the argument for maintaining these “significant distortions” in the capital markets, i.e., historically low interest rates, will begin to lose validity.

“The case for that has disappeared,” he said. “We have crisis-like interventions, but crisis-like conditions no longer exist in the economy. And so the justification and the rationale for significant interventions begins to disappear.” Therefore, the Fed is likely to increase interest rates, directly affecting one of main drivers of CRE and HRE investment.

As things stand, the Fed is shifting its stance from one of promoting a stronger economy through lower interest rates to one of mitigating the risk that low capital costs could be “fermenting asset price bubbles in certain segments of the economy,” he said.

That’s “a legitimate and very credible concern” for the highest-quality commercial real estate, such as trophy office and apartment buildings in gateway markets like New York, he said.

Domestic and foreign capital has poured into CRE, especially the most liquid asset classes, because of its relatively stable characteristics. But oceans of cheap capital chasing a finite number of investment opportunities has led to historically low capitalization (cap) rates and increases in value for some real estate assets, including HRE – and that could change if interest rates rise.

Meanwhile, a dynamic of minimal construction has contributed to an overall inflation of asset prices. So another risk is overbuilding, Dr. Chandan said, as we’re already seeing in the multi-family market. “We no longer exist under a condition of significant supply constraints,” he said.

Historically, the CRE market has maximized construction activity at “the worst possible time,” he noted, in the early stages of economic recoveries. And, as in 2007, “our motivations for building are strongest as we approach the peak of the market in terms of the investment values.”

“This time around has been different,” he said, “because we’ve not seen significant new supply come online over the last couple of years.” But that is starting to change as development picks up.

Why has the economic recovery been so slow?

The Great Recession “has been over again for far longer than it lasted,” Dr. Chandon said, “but for the median American family, it doesn’t feel that way.” That’s because abstract measures of economic activity aren’t important to the average American family, he said. What is important is job security.

The job losses of Great Recession and the time it took to recover those lost jobs were both unprecedented. The feeble job growth of this recovery also means many Americans are still unemployed or underemployed, with little or no wage and salary growth.

“Whether they think we’re in a recovery depends upon their job prospects,” he explained, “and that’s why for most Americans it doesn’t feel like we’ve been in a recovery for very long.”

The sluggish recovery of the residential housing market has also had significant negative effects, he said. In addition to the direct economic impact of reduced home construction and sales, a weak housing market constrains equity growth, which affect homeowners’ perceptions of their wealth and their attitudes toward discretionary spending. On the other hand, Dr. Chandan said that there is a perception that the business cycle is starting to pick up “and so we’ve got some real runway ahead of us.”

But, historically, the average U.S. expansion – from recessions to recession – lasts five years, and June 2014 was the fifth anniversary of this recovery.

“That means for us that if this expansion was like the average expansion … then we’d be approaching its end,” he said, and we don’t have any reason to believe that weak recoveries last longer than stronger recoveries. However, if this recovery really is different, that’s a critical factor to consider in developing strategic plans for the next three to five years.

That uncertainty becomes a critical issue for lenders trying to underwrite loans, he said. One response might, he added, might be to “go long” and assume that this recovery will indeed last longer than most.

But the longest expansion in economic history was exactly 10 years, or 120 months (March 1991 to March 2001), he said, “and that means for us today that, if we go as long as we have ever gone, that at some point within the next three to five years we will experience a period of significant economic stress in the United States.”

Underwriting has softened in some CRE sectors

Dr. Chandan said he teaches his Wharton CRE students that, all things being equal, an increase in the underlying cost of capital historically implies a higher capitalization (cap) rate. But all things are rarely equal, he said. That’s why some short-term spikes in interest rates have not had a significant effect on cap rates.

“And we saw that very clearly in the summer of 2013, where over a fairly short period of time Treasury yields went up by about 130 basis points,” he said.

“If cap rates had gone up by 130 basis points or even 100 or even 90 or 80, we wouldn’t be feeling so confident about the outlook for our sector,” he said. “We would be struggling to understand why it is that we had observed over the matter of just a couple of weeks a significant correction in commercial real estate asset values.

“We would have been reminded, as many people in multi-family sector seem to have forgotten, that commercial real estate asset prices can sometimes go down.”

CRE cannot be decoupled from what is happening in the rest of the economy, he said. And as we talk about how CRE has become a more accepted asset class, that also means it is more integrated into the larger economy and more susceptible to economic change.

We’ve also seen “a significant weakening in underwriting for commercial real estate lending over the course of the last 18 to 24 months,” Dr. Chandan said, “earlier in the multi-family sector; more recently for other property types.” And while lenders might be saying they are tightening their underwriting standards, they also said that in 2006-07 even though it wasn’t true, he said.

“We’re going to hear lenders say we’re not making the same mistakes as last time. That’s okay, but that’s not enough because we can make all sorts of new mistakes,” he said. “And one of the new mistakes that we’re making is in part to offer a larger share of interest-only periods on the loans that we’re originating today.” The risk is not so much that borrowers will be unable to make their payments, he said, it’s that when the loans mature in the future they might not be able to refinance when facing significantly higher interest rates.

“That means for us that probably the worst thing that we can do to undermine the long-term performance of these loans is to reduce the degree of amortization by introducing interest-only,” he said. “And to this extent the multi-family sector can act as a canary in the coal mine for understanding what’s happening with other types of commercial real estate,” because the sector has seen a steady increase in interest-only loans during the past two years.

Will this CRE cycle really be different?

Part of the spike in interest-only multi-family loans has been justified by a contention that fundamental changes are taking place in that sector, he said. The theory is that people’s behaviors are changing, as they are getting married and having children later, renting rather than owning, and choosing to live in downtown areas near certain amenities.

“But when I hear people in commercial real estate start to talk about fundamental changes that have fundamentally redrawn the rules of the game, I start to get worried,” Dr. Chandan said. Only a few years ago, we were saying we had become “a nation of homeowners” and there was a bleak future for the multi-family sector. Today, many are saying just the opposite.

To summarize, Dr. Chandan said we can expect a relatively stable, short-term U.S. economic growth and stronger outcomes in the labor market, although we’re still subject to significant exogenous, or outside, shocks.

“Marginally higher interest rates imply more limited appreciation for a commercial real estate asset,” he said, and the big difference for CRE during the next two years will be that “we cannot rely on interest rates to do for us what fundamentals have not been able to do for us. That will be the basic change that requires that we think differently about our commercial real estate investments and that will fundamentally remind us that the value of our commercial real estate must be anchored in that underlying income.”

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE