Domestic markets, economy continue to react to global market troubles, issues

The most recent month was marked by increased market volatility. From all-time-highs reached in mid-January, the S&P dropped 6.1 percent to 1,738 by Feb. 5. This was followed by a 7.5 percent rise to 1,868 by the end of the month. The VIX (a measure of the implied volatility of S&P 500 index options) spiked from 11.81 to 21.48 during the trough and was back down to 13.49 at the end of the month. Any VIX figure under 15 is considered low and signals market complacency.

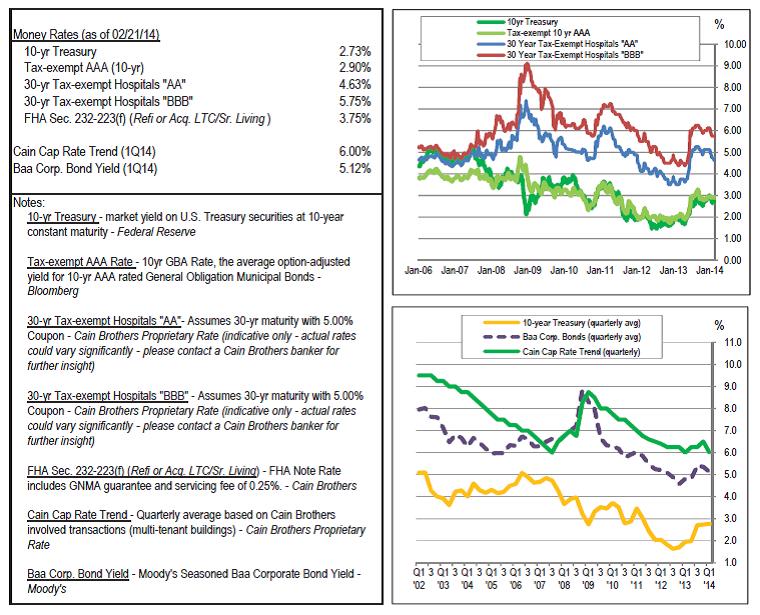

Source: Data provided by Cain Brothers & Co.

Disclaimer: The data is believed to be accurate but is not guaranteed. Wolf Marketing & Media LLC, publisher of HREI™, is not responsible for its accuracy.

The full content of this article is only available to paid subscribers. If you are an active subscriber, please log in. To subscribe, please click here: SUBSCRIBE